Investors are in a unique position as certain stocks are viewed as attractive buy options with considerable potential for growth in the upcoming seasons. Bank of America has made their strong buy recommendations on various companies that are not just surviving but thriving in today’s market. The focus on giants like Nvidia, Netflix, Amazon, and the less conventional Boot Barn suggests a shift towards more diversified investment strategies. Each of these firms carries its own narrative of innovation, scalability, and strategic execution which sets the stage for an exciting investment atmosphere.

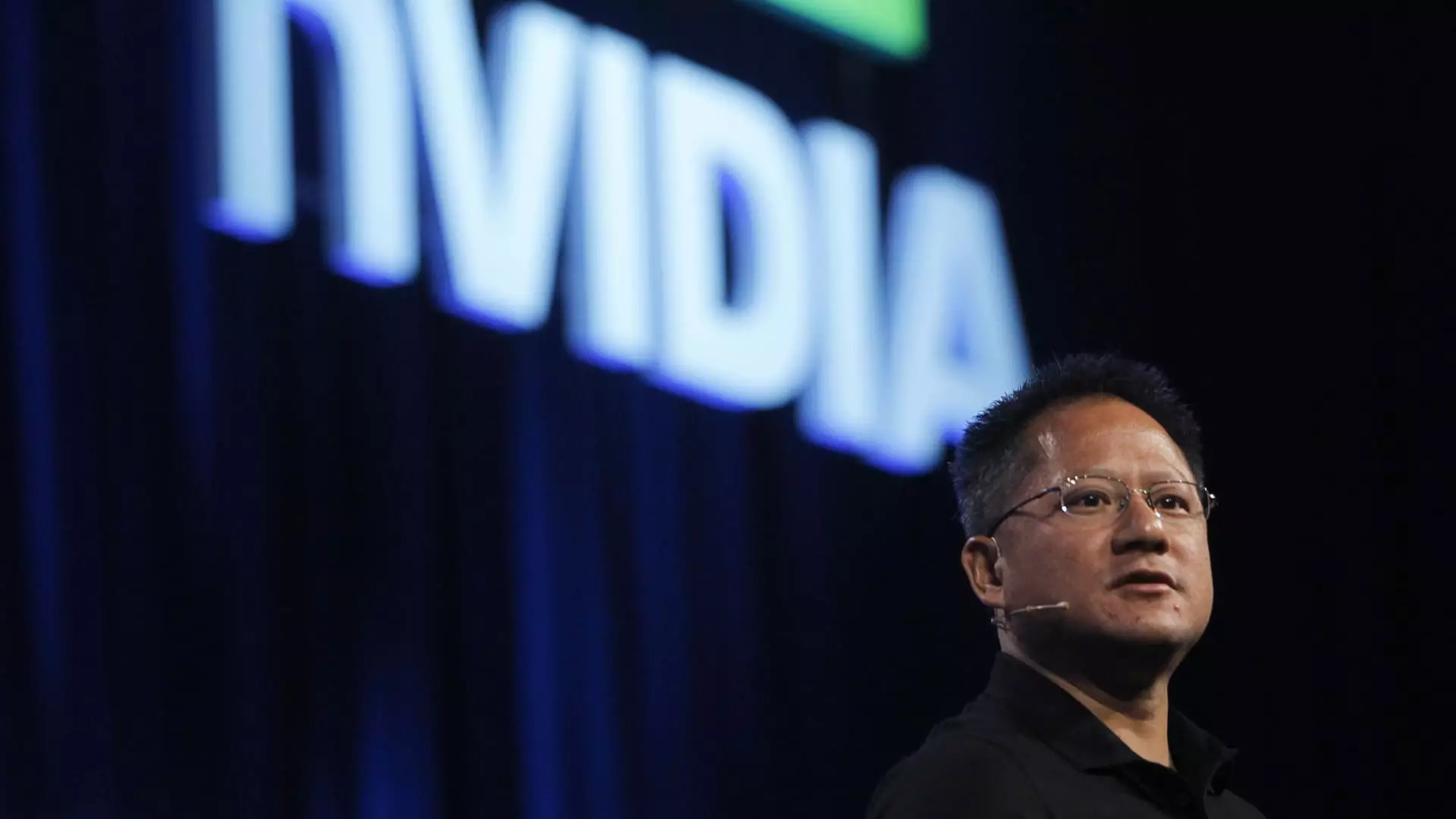

Nvidia: The AI-Powered Leader

At the forefront of technological advancements, Nvidia stands as a prime example of how companies positioned in artificial intelligence (AI) are currently riding an exhilarating wave of demand. The corporation’s strategic investments and years of research are finally paying strong dividends, leading analysts to agree on its status as a top pick. With Nvidia carving its niche firmly in AI technology, the robust consensus is that the company is set to capitalise on a multi-year growth trajectory. It’s not merely about the numbers anymore; Nvidia’s market leads in performance and developer relationships create a formidable barrier for competitors.

However, the danger lies in overestimating the sustainability of this growth. The stock market can behave irrationally, and while Nvidia is riding the crest today, future volatility could deliver harsh realities. Dismissing external factor risks like geopolitical tensions or sudden market corrections can lead to devastating financial repercussions. Investors need to tread carefully, navigating through the noise surrounding potential regulatory interventions or competition breakthroughs.

Netflix: The Streaming Juggernaut

Netflix seems to have been reinvigorated by a resurgence in subscriber growth coupled with a strategic pivot into advertising technology. Bank of America’s boost of the target price reflects a bullish sentiment that is hard to ignore. The company has demonstrated a remarkable ability to adapt and thrive despite rising competition, reinforcing its enduring dominance in the streaming sphere. Its increasing investment in advertising is a game-changing strategy that not only diversifies revenue streams but propels it forward in an industry characterized by rapid changes.

Still, one cannot overlook that Netflix’s valuation may become precariously inflated if growth expectations are not met. The pressure from competitors like Disney+ and HBO Max is mounting, and Netflix must consistently innovate to maintain its pole position. There is an undercurrent of skepticism regarding the long-term viability of their subscriber growth model, especially as economic conditions may pressure consumer spending. Thus, investing in Netflix should come with an understanding of the fickle nature of entertainment consumption patterns.

Amazon: Leveraging Robotics for Enhanced Competitiveness

Amazon’s aggressive integration of robotics signifies a paradigm shift in its operational capabilities. Analyst optimism is grounded in the belief that robotics will not only optimize efficiencies but will also fortify Amazon’s already powerful market stance. As e-commerce continues to evolve, the ability to deliver quickly and accurately becomes increasingly critical. This strategic foresight could enhance profit margins significantly, making the company a worthwhile prospect for forward-thinking investors.

However, the path for Amazon is fraught with challenges. Intense scrutiny regarding labor practices, antitrust investigations, and supply chain disruptions pose tangible threats to its expansive model. While there are clear advantages in automation, there is also the moral responsibility that investors must consider regarding job displacement and ethical business practices. Engaging with Amazon means buying into its dual legacy: a pioneer in innovation and a lightning rod for criticism in corporate responsibility.

Boot Barn: A Rising Star in the Retail Space

As unconventional as it may sound, Boot Barn is witnessing substantial growth, propelled by positive consumer trends and favorable pricing environments. This Western-themed retail company may seem niche, yet it taps into a perfect blend of lifestyle branding and authentic customer engagement that many larger competitors lack. Given the company’s expanding market share across various categories, its potential for continued growth cannot be easily dismissed.

Nevertheless, potential investors should consider the volatility characteristic of retail stocks, particularly those in a specialized market. The allure of Boot Barn might just be a flash in the pan, as consumer behaviors can rapidly evolve. Any miscalculation on future consumer preferences could spell disaster, especially if a broader economic downturn impacts discretionary spending.

The current investment climate is fraught with opportunities but equally riddled with risks. Navigating through this stock selection requires astutelty and foresight. Those inclined to invest in these dynamic companies must maintain a vigilant approach, always attuned to broader economic indicators and market sentiment shifts to safeguard their investments against unforeseen downturns.

Leave a Reply