Britain’s economic landscape is increasingly comparable to a house of cards teetering on the edge of collapse. Recent forecasts from the National Institute of Economic and Social Research (NIESR) reveal a disconcerting reality: the government faces a staggering shortfall of over £40 billion in its upcoming budget. This looming gap threatens to derail the very fiscal rules that underpin economic stability, exposing a fragile balancing act driven by political commitments and economic constraints. It’s a stark wake-up call that Britain’s financial strategy may be more illusion than reality, and unless bold, perhaps radical, measures are adopted, the nation risks plunging into deeper economic unrest.

The perilous trap of political promises versus economic reality

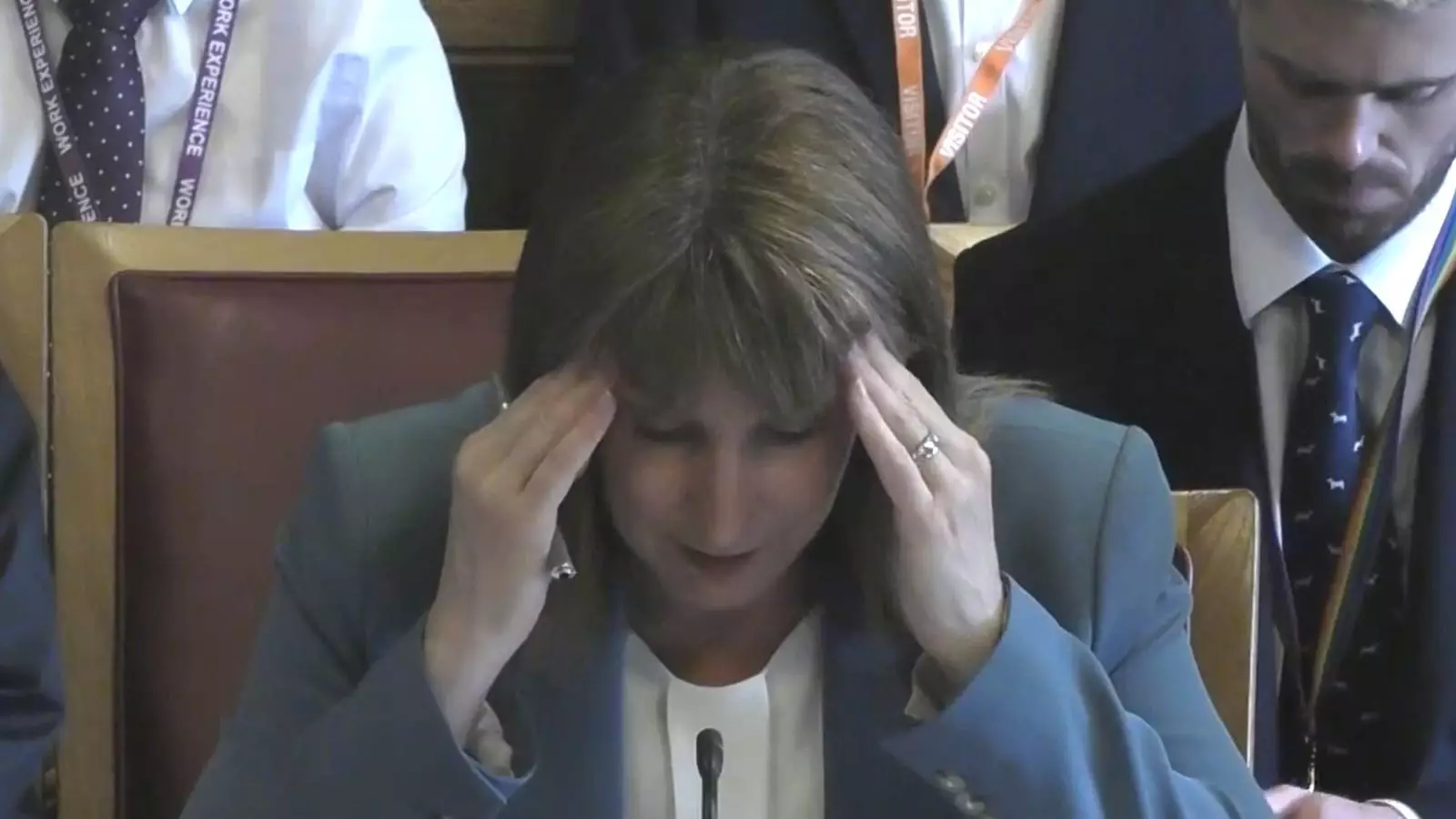

Reeves’ government is caught in a precarious trap. On one side, they are bound by their manifesto pledges that resist tax hikes, and on the other, they are forced to maintain essential spending commitments. The current forecast suggests that to stay within their fiscal rules, they’ll need to implement enormous tax increases or slash spending—either option with drawbacks. The political will to avoid tax hikes clashes with the economic necessity of revenue generation, revealing a fundamental flaw: short-term political expediency undermining long-term fiscal health. This dilemma exemplifies how political narratives often clash with economic realities, leaving the country vulnerable to market instability and increased borrowing costs.

Reimagining tax policy—modest reforms or radical overhaul?

The NIESR advocates for strategic tax reforms that could bolster Britain’s fiscal resilience. It suggests that modest yet sustained adjustments—such as reforming council tax bands or even replacing the entire system with land value taxes—could generate the revenue needed to bridge the projected deficit. These proposals challenge the status quo, emphasizing that the current tax system is outdated and insufficient for future needs. A land value tax, for example, could incentivize more productive land use, reduce speculation, and provide a more equitable source of revenue. However, the political and social resistance to such reforms is daunting, and their implementation would require political courage and a willingness to confront vested interests—traits that are often scarce in Westminster.

The danger of fiscal complacency amid sluggish growth

Economic growth remains sluggish, hovering around a meager 1.3% in 2025 and 1.2% in 2026. This lethargic pace exacerbates fiscal tensions, as revenue growth lags behind public spending needs. Simultaneously, inflation persists at levels that erode living standards, particularly for Britain’s most disadvantaged. The poorest tenth of households are suffering a 1.3% decline in living standards amid rising prices and stagnant wages. The combination of slow growth and persistent inflation is a toxic cocktail threatening social cohesion and economic stability. It’s clear that without genuine structural reforms, Britain’s economy risks being a constant cycle of stagnation and intractable inequality.

Interest rate cuts—short-term relief or long-term peril?

Amid these economic pressures, the Bank of England plans to cut interest rates from 4.25% to 3.5%, a move aimed at boosting growth. While lower borrowing costs could provide short-term relief, they also risk overheating inflation if not carefully managed. Historically, rate cuts in such circumstances have temporarily eased credit conditions, but they may also sow the seeds for future instability if inflation remains persistent. The decision highlights a superficial approach—favoring quick fixes rather than addressing underlying structural issues. Relying on monetary policy alone without fiscal discipline risks turning Britain’s economic ship into an uncontrollable vessel heading into the storm.

The unspoken reality: living standards are falling, inequalities rising

The most troubling aspect of Britain’s current economic trajectory is its impact on the populace. The persistent inflation thus far has disproportionately affected low-income households, pushing them further into hardship. As living standards decline for the poorest, the socio-economic gap widens, undermining social cohesion. This trend reveals a systemic failure to ensure equitable economic growth. It questions whether current policies genuinely aim to create a fair society or merely gloss over the cracks with short-term monetary measures. Unless decisive action is taken to promote sustainable growth and social inclusion, Britain risks entrenched inequality that could threaten its social fabric for generations to come.

—

The current economic outlook reveals uncomfortable truths: Britain’s fiscal policies are unsustainable, its growth prospects are bleak, and social disparities are intensifying. The government’s reluctance to pursue meaningful tax reforms or structural economic change suggests a prioritization of short-term political stability over long-term resilience. This complacency risks turning Britain into a debt-ridden economy, where fleeting monetary adjustments mask deeper structural failures. Instead of settling for superficial fixes, bold leadership rooted in pragmatic and equitable reforms is essential—before the economic house of cards completely collapses.

Leave a Reply