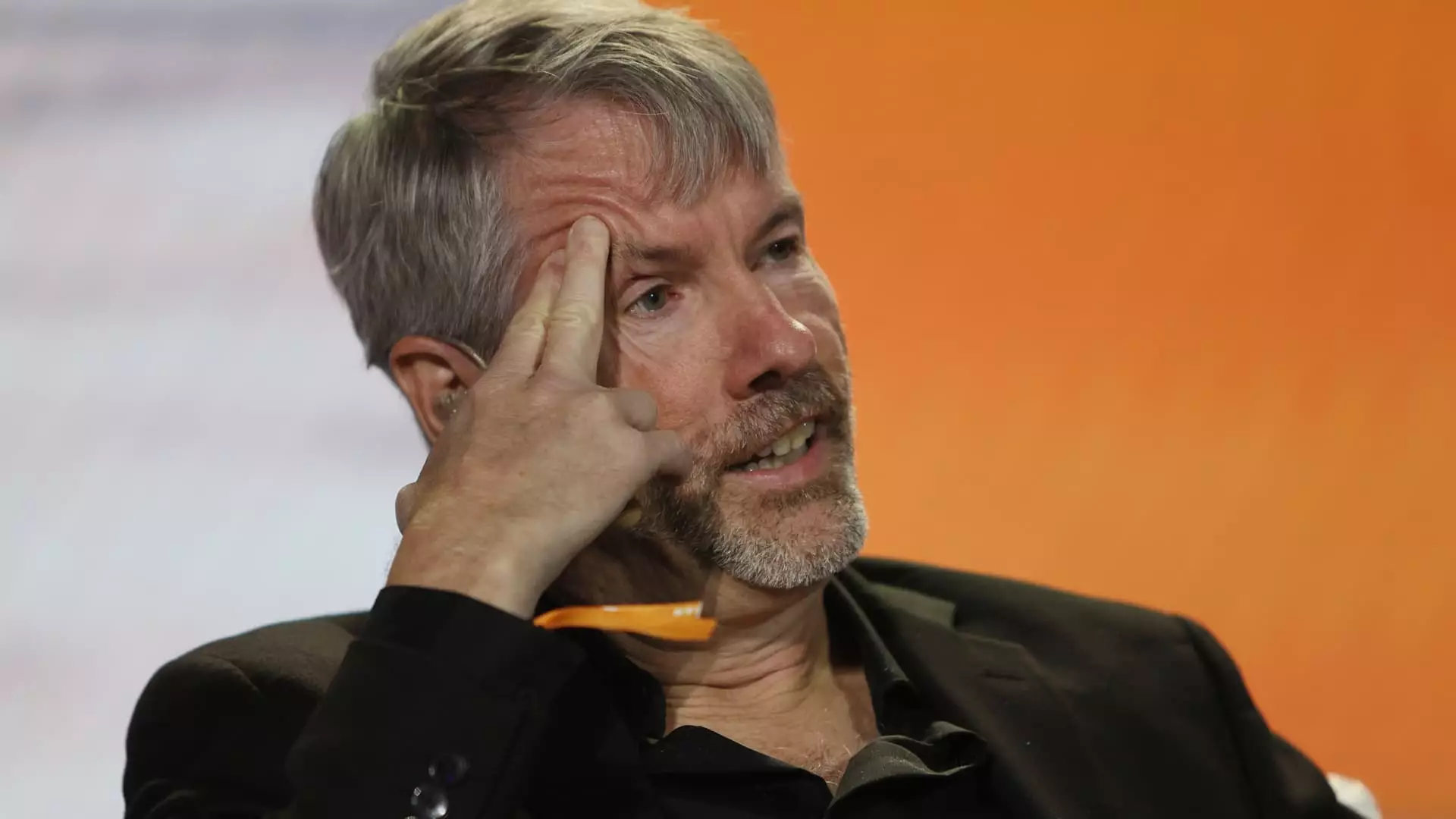

In a bold move illustrating the intersection of traditional business practices and modern cryptocurrency investment, Michael Saylor has once again taken center stage. The billionaire entrepreneur, who famously transformed MicroStrategy into a major player in the Bitcoin market, recently made a case for Microsoft to invest a significant portion of its massive cash reserves into Bitcoin. This proposal surfaced during Microsoft’s annual shareholder meeting but was met with firm resistance from its shareholders, indicating a significant divide between traditional corporate governance and the disruptive potential of cryptocurrency.

Saylor’s campaign to advocate for Microsoft investing in Bitcoin isn’t entirely without merit. His assertions are backed by compelling data, notably that Bitcoin has outperformed traditional investments, including stocks and bonds, yielding an impressive annual return of 62% from August 2020 to November 2024. In stark contrast, Microsoft itself reported only an 18% increase, while the S&P 500 delivered mere 14% returns with bonds losing 5%. This notable discrepancy casts Bitcoin not only as a speculative asset but as a sound investment strategy—one that could realistically offer substantial returns to shareholders.

Resistance from the Established Giants

Despite the allure of Saylor’s arguments, Microsoft’s management, including CEO Satya Nadella and financial chief Amy Hood, remained unconvinced. During the shareholder meeting, Hood referenced Microsoft’s prior explorations into cryptocurrency as part of its treasury operations, emphasizing a cautious yet open-minded approach to the evolving landscape of digital currencies. She reiterated that the company has continuously monitored developments in cryptocurrency while outlining their interest in maintaining fiscal responsibility, a clear sign that they may not be ready to dive headfirst into the volatile world of Bitcoin.

Furthermore, proxy advisory firms like Glass Lewis and Institutional Shareholder Services advised shareholders against supporting Saylor’s proposal, suggesting that the risks associated with such an investment outweighed the potential benefits. Microsoft investors might value stability over the unpredictable swings that characterize cryptocurrency markets, particularly when traditional markets still offer reliable—if lower—returns.

Saylor’s strategy, wherein he linked MicroStrategy’s fortunes directly to Bitcoin, has been both groundbreaking and risky. Since mid-2020, when he committed to investing a substantial sum in Bitcoin, MicroStrategy’s market cap surged to about $83 billion. By accumulating approximately 423,650 Bitcoins valued at over $41.3 billion at current trading prices, Saylor has positioned his company at the vanguard of the cryptocurrency revolution. However, this approach has also made MicroStrategy highly susceptible to the fluctuations of the crypto market.

Interestingly, the tech giant’s gamble on Bitcoin has elevated Saylor’s net worth to an astronomical $9.1 billion, creating an image of success that is enticing yet may not resonate with conservative investors focused on long-term stability. This dual reality—instant wealth for Saylor and substantial risk for MicroStrategy—is emblematic of the broader crypto trend where rewards can be immense but are accompanied by profound uncertainties.

Saylor’s assertion that “Microsoft can’t afford to miss the next technology wave, and Bitcoin is that wave,” encapsulates a growing belief among some investors that digital currencies could fundamentally reshape financial landscapes. However, this notion remains a contentious point among institutional investors. Microsoft has already integrated cryptocurrency into its payment systems since 2014 but has thus far opted for a more conservative approach towards significant investments.

Ultimately, the decision to dive into Bitcoin—or any cryptocurrency—reflects broader trends in the technology and finance sectors, where risk tolerance and visionary leadership become critical. As MicroStrategy continues to play high-stakes poker with Bitcoin, the world watches to see if their pioneering efforts will create a lasting influence or serve as a cautionary tale, underlining the age-old proverb that great risk often accompanies great reward.

In the wake of this scenario, attention now shifts back to Microsoft. Will they heed Saylor’s call and embrace the potential transformation that Bitcoin offers, or will they remain grounded in their established practices, valuing stability over speculation? The answer could help determine the company’s trajectory amid a rapidly changing technological landscape.

Leave a Reply