The semiconductor industry is experiencing a notable surge, recently catalyzed by an impressive announcement from Foxconn, formally known as Hon Hai Precision Industry. As a major contract electronics manufacturer and key supplier for tech giants like Apple, Foxconn’s record fourth-quarter revenue demonstrates the exponential growth potential within the semiconductor sector, spurred primarily by the escalating demand for artificial intelligence (AI) technologies. This article delves into the nuances of this growth, its implications for the sector, and the broader market trends emerging as a result.

Foxconn reported a staggering 2.1 trillion New Taiwan dollars (approximately $63.9 billion) in fourth-quarter revenue, marking a 15% year-over-year growth. This landmark achievement not only highlights the company’s operational efficiency but also underscores the burgeoning demand for AI-related products, notably cloud and networking solutions that incorporate sophisticated AI servers. Such performance is not merely a statistic but a signal of the broader market’s robustness, especially as tech companies pivot towards AI-driven models that necessitate powerful semiconductor solutions.

While Foxconn’s strong revenue figures are bolstered by AI-focused segments, the company did note slight declines in sales of computing products and consumer electronics such as smartphones. This mixed performance interpretation reveals the complexities within the industry—while certain sectors thrive, others experience stagnation. Nevertheless, the overall impact on investor sentiment has been overwhelmingly positive, driving shares of leading semiconductor manufacturers upward.

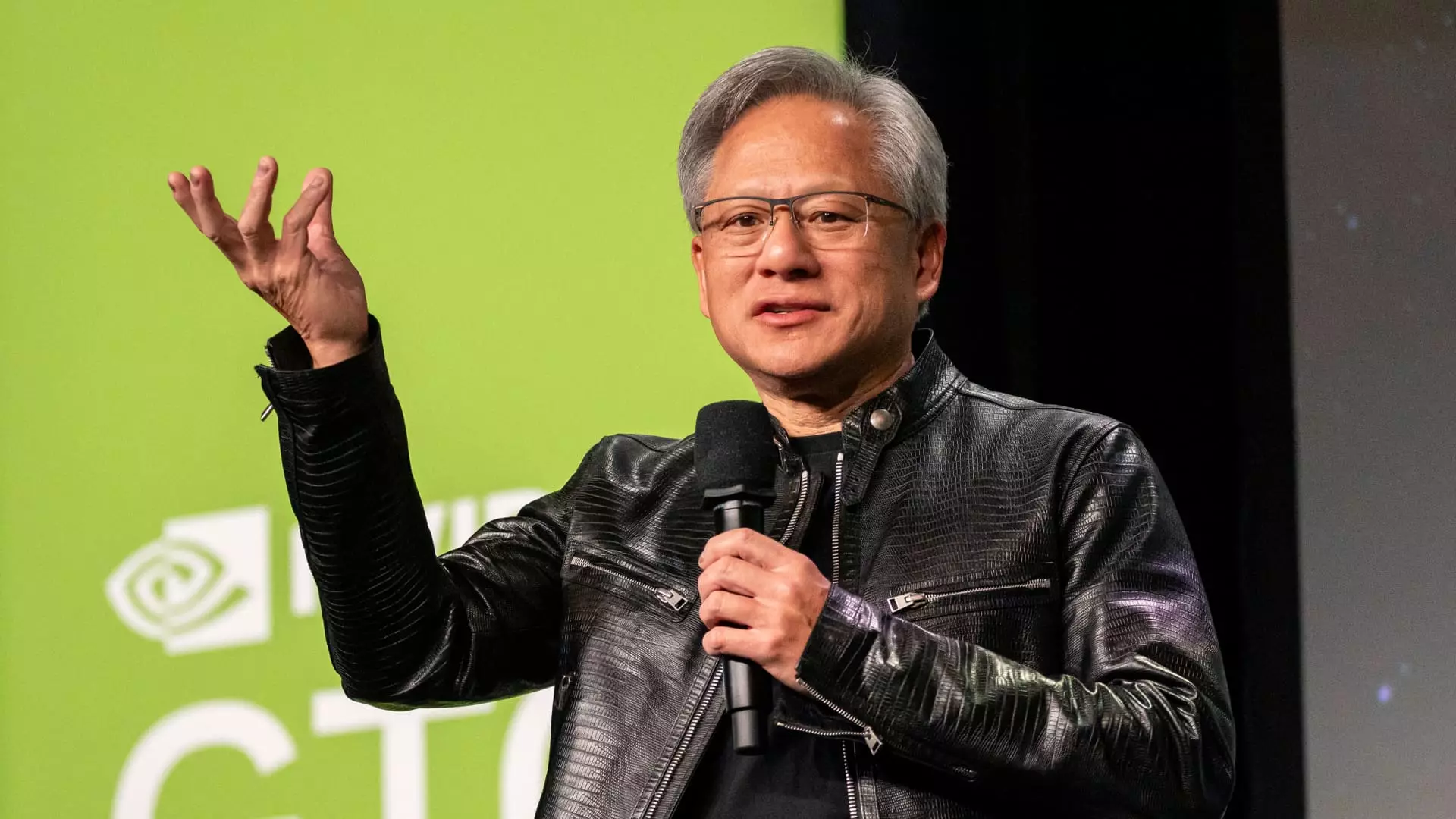

The substantial gains in Foxconn’s revenues sparked a wave of optimism in the semiconductor market. Shares across the globe showed upward trends, particularly in Asia, Europe, and the United States. Notably, Nvidia experienced a boost of over 3%, a clear reflection of its strategic positioning as a leader in GPU technology, essential for AI workloads.

Investors also reacted favorably to announcements from tech behemoths like Microsoft, demonstrating the growing investment in data centers designed specifically to support AI operations. These developments signal a tectonic shift in how major corporations perceive and prioritize technological infrastructure, particularly components reliant on high-performance semiconductors. The enthusiasm among investors is palpable, with AMD and Qualcomm also climbing significantly, further reflecting market confidence.

Regional dynamics in the semiconductor industry present an intriguing portrait of competition and innovation. Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest semiconductor chip producer, reached a record high, closing with nearly a 5% gain. TSMC’s ability to produce chips for prominent companies like AMD and Nvidia highlights its pivotal role in the global supply chain.

In South Korea, firms such as SK Hynix and Samsung mirrored this trend, achieving impressive share price increases. Similarly, in Europe, companies like ASML and Infineon showcased remarkable growth, further solidifying the notion that across geographic boundaries, the semiconductor industry is collectively benefiting from the AI-driven demand surge.

While the current surge in semiconductor stocks is encouraging, it is imperative for investors to approach the market with a tempered mindset. The rapid escalation in revenue marks a significant recovery and growth phase, yet it is essential to remain cognizant of potential overextensions and market corrections. As companies strategize to meet the relentless demand for AI technologies, the necessity for sustained innovation and investment in scalable production processes becomes paramount.

As the industry continues to evolve, stakeholders must prioritize adaptability in their operational frameworks. Navigating the technical challenges accompanying the AI revolution will not only require robust semiconductor manufacturing capabilities but also an unyielding commitment to research and development. The dynamic interplay between supply and demand will heavily influence future investments and market performance.

The recent rally in semiconductor stocks, catalyzed by Foxconn’s exceptional quarterly earnings and an ongoing global pivot towards AI, marks a transformative period for the industry. As investors capitalized on this momentum, the semiconductor sector’s essentiality to modern technology has become more apparent than ever. Future growth hinges on the ability of firms to innovate and effectively respond to the rapidly evolving landscape, but for now, the sky appears to be the limit for this pivotal industry.

Leave a Reply