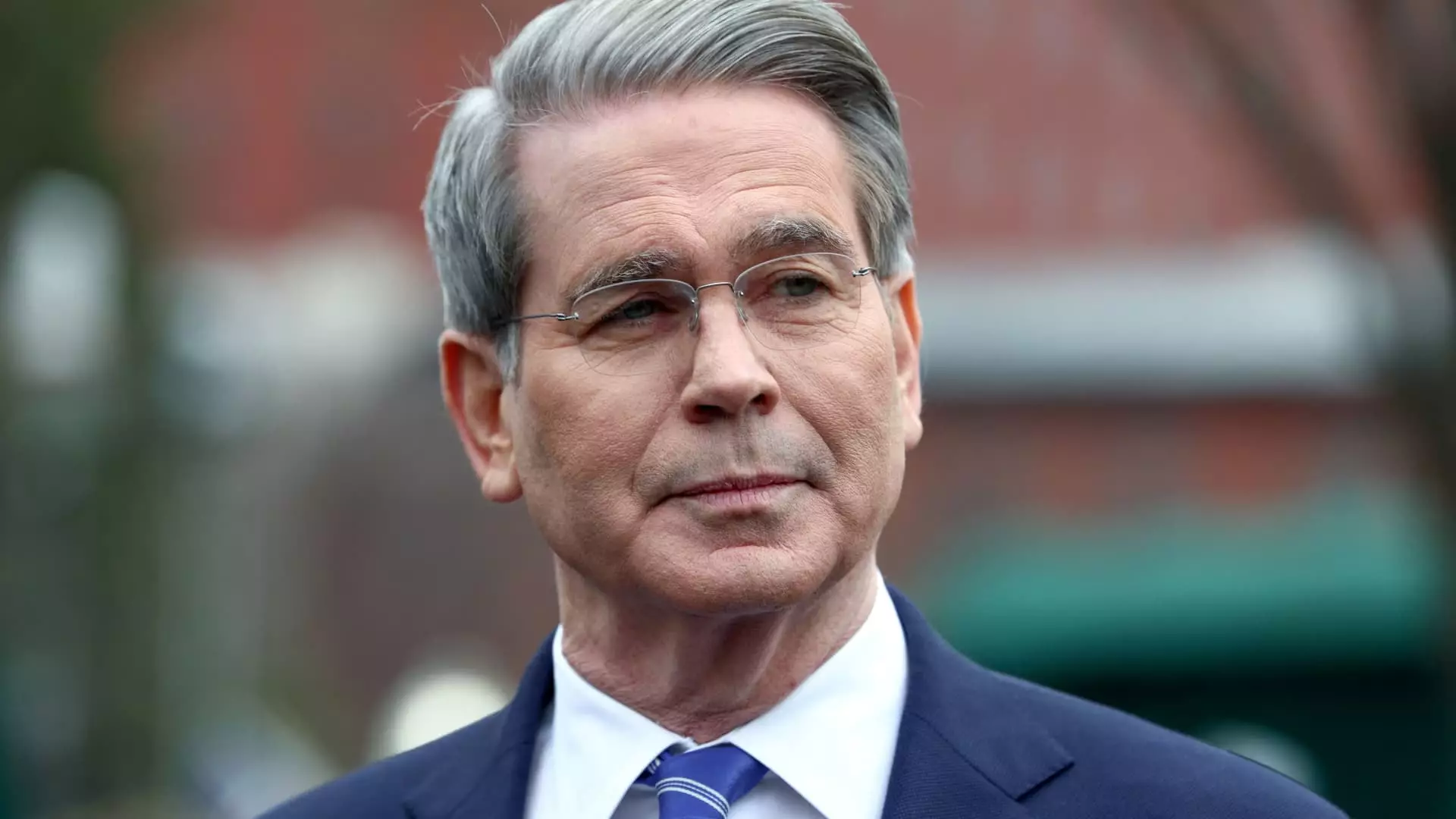

The recent comments made by Treasury Secretary Scott Bessent have ignited a firestorm of debate over the state of the American economy, particularly amongst those on the verge of retirement. His assertion that the current market downturn and concerns surrounding retirement accounts are merely “false narratives” is not only dismissive but also dangerously misleading. This perspective reflects a certain detachment from the harsh realities many Americans are grappling with today. In a time of fluctuating job security and rising costs, it is troubling that economic leaders seem to believe that simple optimism can shield citizens from their financial woes.

Bessent’s claims that “most Americans don’t have everything in the market” elicit skepticism, as it glosses over the broader context of personal finance in a post-pandemic world. For many individuals preparing for retirement, their savings are vulnerable to the ebbs and flows of the stock market, and despite Bessent’s reassurances about long-term growth, the pain inflicted by market volatility is immediate and real. People have entrusted their hard-earned money to retirement accounts that are now susceptible to the whims of economic policy and global market conditions.

The Illusion of Long-Term Fundamentals

When Bessent asserts that the Trump administration is “building the long-term economic fundamentals for prosperity,” one must question the metrics by which these claims are measured. The fundamental shift he references seems more like a gamble on economy-wide tariffs rather than a sustainable economic strategy. Following Trump’s tariff announcement, the market’s violent reactions indicate a lack of confidence in this “revolution” that Bessent elaborates upon. Instead of economic rejuvenation, we appear to be witnessing prolonging uncertainties that will weigh on growth and consumer confidence for years.

As tariffs escalate to alarming levels, Secretary Bessent should be asking why a significant number of investors and everyday citizens are expressing unease. The flickering optimism from fiscal authorities is jarring against the backdrop of stock losses that haven’t been felt since the onset of the COVID-19 pandemic. It’s essential to grasp that while economic policies may aim for transformative change, their initial impact can be profoundly destabilizing—and this volatility is not reflective of a healthy economy.

Comparative Regress: Reckoning with History

Bessent’s comparison of the current landscape to the era of President Reagan, where inflation was curbed at great cost, echoes a concerning trend in economic management. While historical references can provide valuable context, they cannot serve as blanket explanations for contemporary problems. Each economic situation is unique, heavily influenced by present-day global dynamics. The “adjustment process” he refers to—as if merely enduring temporary instability suffices— disregards the lived experiences and anxieties that affect real Americans every day.

The projection of tariffs and brusque economic strategies raises foundational questions about the ethical guidelines governing our trade relationships. Are we simply choosing a route that benefits political rhetoric and short-term gains at the expense of long-term consumer security? The “unsustainable system” to which Bessent refers appears to be an oversimplification of complex economic realities, insisting that trade partners are to blame while neglecting systemic issues within the American economy itself.

Vigilance Amidst Optimism

Ultimately, Bessent’s comments reflect a broader political sentiment that prioritizes a particular narrative of American economic exceptionalism over the genuine fears of its citizens. The encouragement to “hang tough” gains no traction for those who see their savings dissipating or their retirement dreams dimming against the backdrop of increasingly uncertain economic policies. As a society committed to progress and prosperity, we must cultivate a more realistic dialogue about the financial challenges that everyday Americans face rather than embellishing a narrative that may only serve the interests of the political elite.

In this climate of potential economic upheaval, it is imperative for citizens to remain vigilant, temper expectations, and demand transparency from those at the helm of fiscal policy. While long-term views are crucial, the economy cannot afford to overlook the immediate consequences of decisions that produce insecurity for millions. Acknowledging these complexities is essential for fostering genuine trust between leaders and the citizens they serve.

Leave a Reply