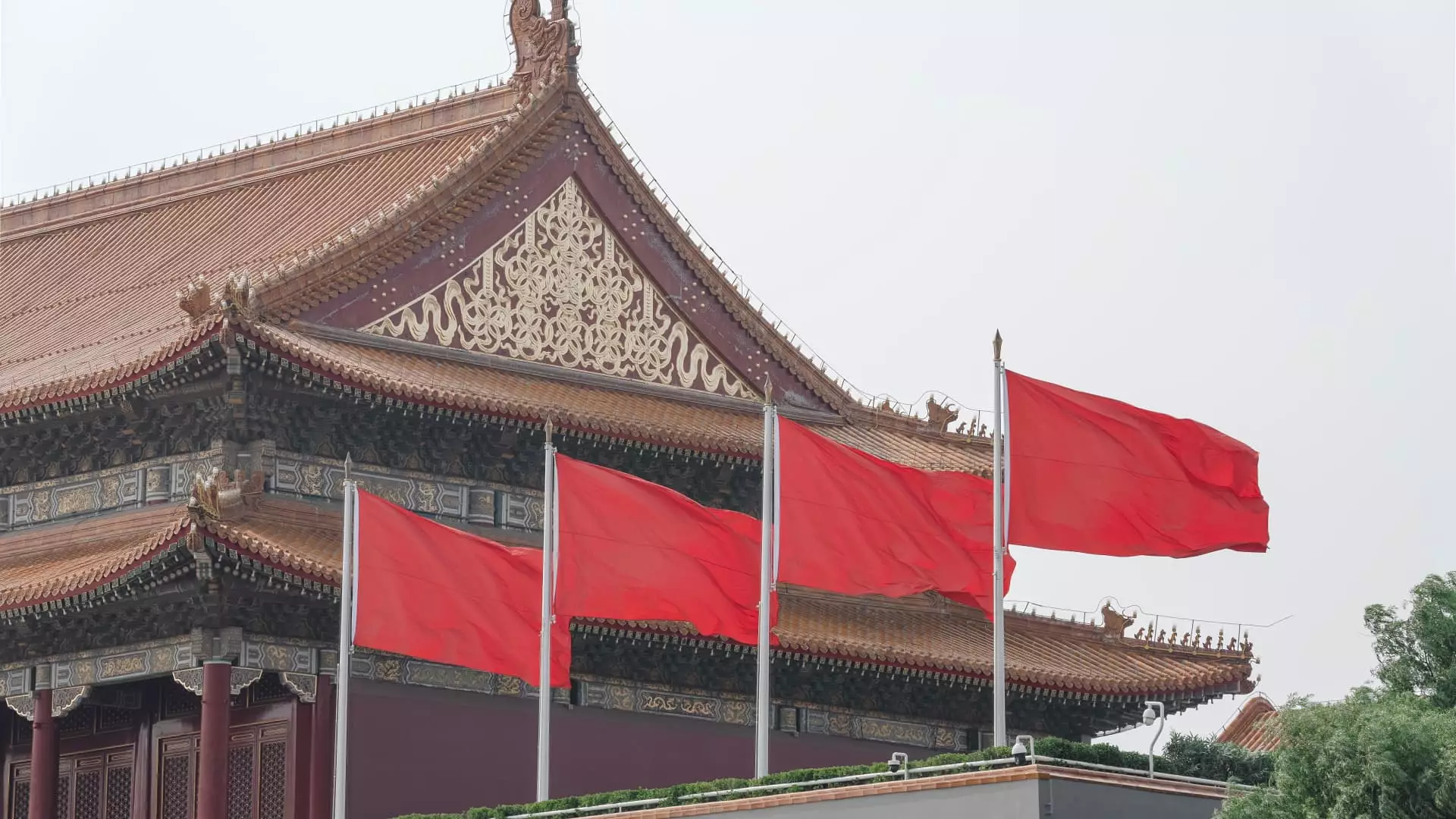

The financial landscape in the Asia-Pacific region displayed marked improvement on Thursday, fueled by a resurgence in investor sentiment following recent economic stimulus measures implemented by the Chinese government. The CSI 300 index, which tracks major companies listed in Shanghai and Shenzhen, has achieved an impressive five-day winning streak, reaching its highest point in nearly two months. This surge comes in the wake of Beijing’s proactive economic strategies unveiled on Tuesday, aimed at bolstering economic growth amidst ongoing global uncertainties.

As a result of these supportive policies, mainland Chinese markets are expected to maintain upward momentum, signalling potential stability in the economic outlook. Investors appear optimistic, spurred by the idea that government interventions can mitigate some of the economic challenges currently faced in the region. Such movements indicate a renewed confidence in the potential for recovery within China’s vast economy.

Hong Kong’s financial markets are poised to continue their positive trajectory, with futures data hinting at a third consecutive day of gains for the Hang Seng Index. Latest figures indicate that HSI futures surged to 19,336, surpassing the previous closing figure of 19,129.1. The index has now reached its highest level since May, suggesting a synchronized rebound that reflects broader movements seen in mainland Chinese markets. These developments underscore the interconnectedness of regional markets and the influence of Chinese economic policy on Hong Kong’s financial performance.

Investors seem to be responding favorably to the trends, indicating that Hong Kong’s market might benefit substantially from renewed economic activities in the region. Coupled with Hong Kong’s unique position as a financial hub, its markets are likely to attract both domestic and foreign investments amid the prevailing optimism.

In Japan, early trading saw the Nikkei 225 jump by 1.7%, with the broader Topix index rising by 1.2%. These gains were further supported by the release of the Bank of Japan’s meeting minutes from July, which sparked optimism among traders regarding future monetary policy directions. The insights from these minutes suggest ongoing support for monetary easing, contributing to an upbeat market sentiment.

Similarly, South Korea’s market displayed impressive resilience, with the Kospi soaring by 1.77%, leading regional gains. The small-cap Kosdaq index also noted an increase of 1.51%, further demonstrating the overall bullish trend in the region. This robust performance hints at a general trend of recovery, likely driven by domestic economic conditions and regional cooperation.

Conversely, the overnight performance in U.S. markets highlighted a contrasting scenario. Major indices such as the Dow Jones Industrial Average and the S&P 500 experienced minor declines, retreating from their recent record highs. Specifically, the S&P 500 fell by 0.19%, while the Dow saw a more significant drop of 0.7%. This divergence between Asian and U.S. markets raises questions about sustaining bullish trends amid varied economic signals across different regions.

Overall, the upward trajectory exhibited by Asia-Pacific markets on Thursday reflects a complex interplay of local and global factors, with China’s economic stimulus serving as a pivotal catalyst. As market participants continue to navigate this evolving landscape, the sustained gains in Asia could signify a broader trend of economic recovery and investment optimism in the region.

Leave a Reply