The recent financial developments in the tech industry have created a significant shift in market capitalization dynamics. With Nvidia’s shares plunging more than 8% following disappointing quarterly earnings, Apple now stands as the sole entity in the exclusive $3 trillion market club. This downturn in Nvidia’s stock has effectively erased approximately $273 billion in value, reducing its market cap to $2.94 trillion. The broader market was also affected, as evidenced by the 1.6% decline in the S&P 500 and a 2.8% drop in the Nasdaq. The repercussions of Nvidia’s missed expectations illustrate the volatility inherent in the tech sector and prompt questions about the sustainability of high valuations.

Nvidia’s stock has taken a notable hit in 2025, having lost 10% year-to-date amid rising investor concerns. Factors such as stringent export controls, potential tariffs, the emergence of more efficient AI models, and an overall deceleration of growth have contributed to a climate of uncertainty. Despite these challenges, it is essential to recognize that Nvidia’s valuation is still remarkable; it is worth five times more than it was two years ago, encapsulating the frenzy surrounding the generative AI landscape. The company’s initial market cap of $3 trillion came in June 2024, but its recent fall from grace has been a stark reminder of how quickly fortunes can change.

Interestingly, the quarterly results Nvidia released did showcase a higher-than-expected performance, with a revenue surge of 78% compared to the previous year, totaling $39.33 billion. The data center segment, crucial for Nvidia’s future, displayed an impressive 93% increase in revenue—nearly reaching $36 billion. These figures reflect the robust demand for Nvidia’s graphics processors tailored for AI applications, despite the tumultuous external environment. Nvidia’s optimistic outlook for the upcoming fiscal quarter indicates recovery as production bottlenecks related to their next-generation chip, Blackwell, have predominantly been addressed.

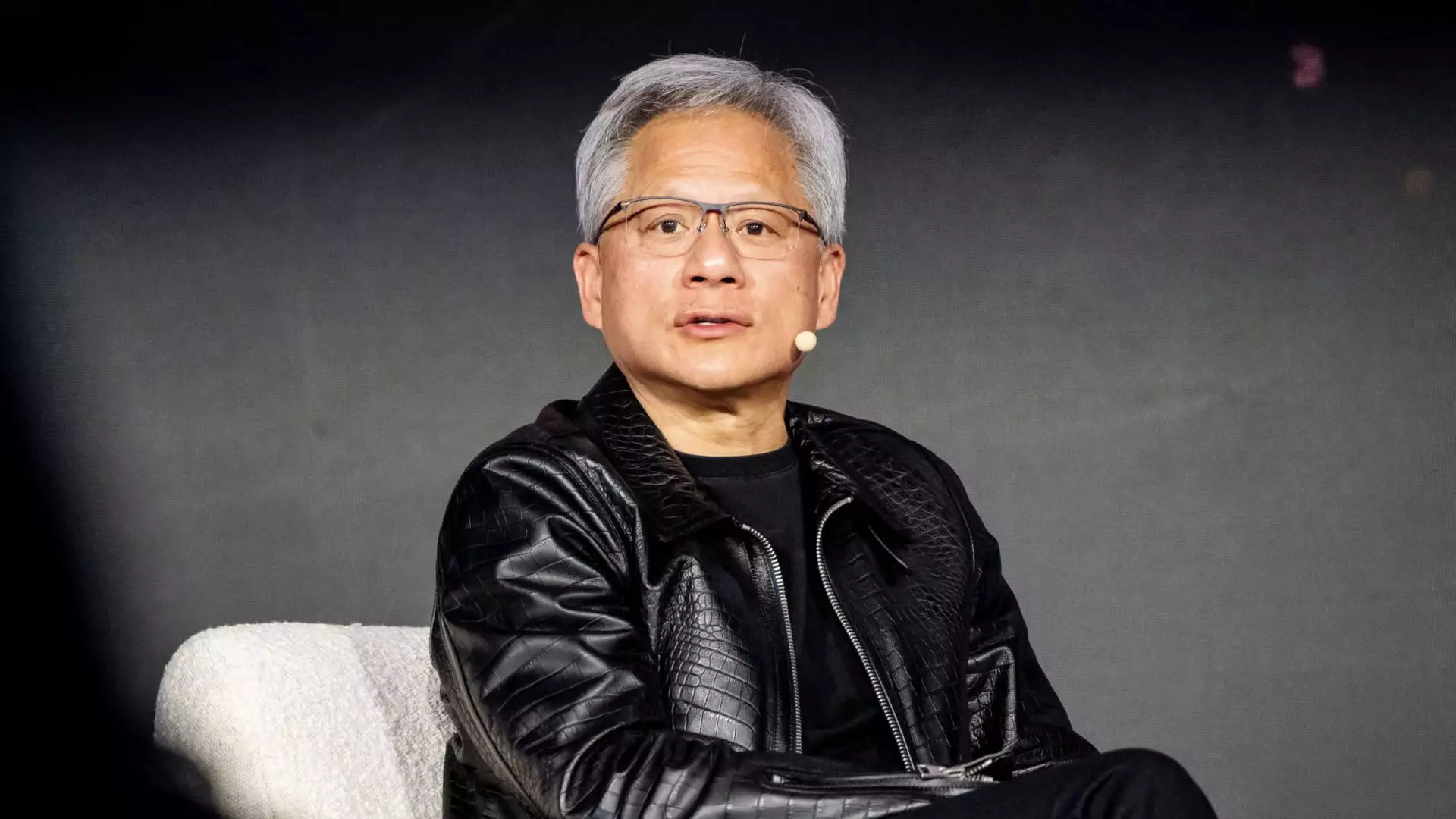

Nvidia’s CEO, Jensen Huang, has conveyed a strong belief in the enduring demand for their chip technology. He emphasized that next-generation AI demands increased computational power to facilitate complex reasoning processes that far exceed historical requirements. Huang remarked on the amount of computation needed for advanced AI models, which can be up to 100 times greater than previous benchmarks. This assertion demonstrates a clear trajectory of expansion in the AI field, positioning Nvidia to capitalize on infrastructure expenditure driven by the leading tech giants like Microsoft, Google, and Amazon, which collectively generate about half of Nvidia’s data center revenue.

While Nvidia currently grapples with a variety of challenges impacting its stock performance and overall market perceptions, its underlying business fundamentals remain strong. As the tech industry evolves, Nvidia’s resilience will be tested against the backdrop of regulatory pressures and competition within the AI domain. Navigating this turbulence will be crucial not only for Nvidia’s return to growth but also for maintaining its status as a critical player in the tech hierarchy, where Apple currently shines brightly at the top. As both companies continue to innovate, their paths will undoubtedly influence the broader market landscape.

Leave a Reply