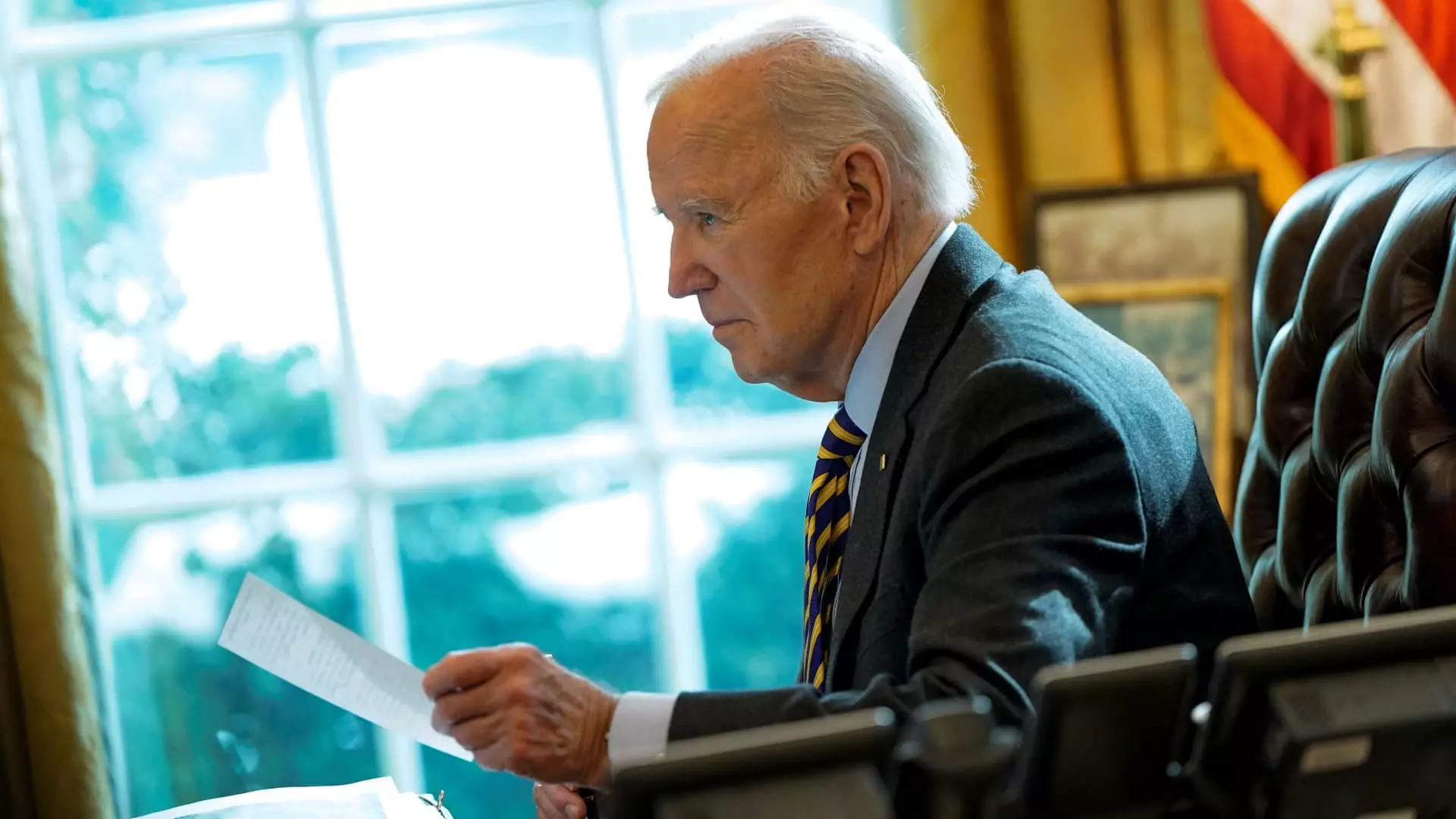

In a pivotal move reflective of both domestic and international stakes, the Biden administration has temporarily stalled a significant acquisition involving Nippon Steel’s $14.9 billion bid for U.S. Steel. This decision, which comes after President Biden initially blocked the sale citing national security concerns on January 3, highlights the intricate balance policymakers must strike between economic interests and national security. With this uncertainty in the steel sector, reactions from both corporate entities and the international community are surfacing, revealing layers of complexity inherent in foreign investments.

The delay until June provides the steel companies involved with an opportunity to mount a legal challenge against the administration’s stance. Both Nippon Steel and U.S. Steel are contesting that the Committee on Foreign Investment in the United States (CFIUS) did not grant them an impartial review. Historically, CFIUS reviews have been crucial in assessing potential threats that foreign investments may pose to national security, but the politicization of such assessments can lead to broader implications for international business relations.

In light of the administration’s previous actions, Nippon Steel and U.S. Steel have launched a lawsuit asserting that the CFIUS review was predetermined due to Biden’s explicit opposition to the merger. This raises significant questions about the fairness and transparency of the interagency review process. Legal maneuvers to overturn the president’s decision could set a precedent not only for this specific merger but also for future foreign investments, as companies might seek recourse to the courts when they perceive bias in governmental reviews.

The companies released a statement expressing their optimism about the extension granted by CFIUS: “We look forward to completing the transaction, which secures the best future for the American steel industry and all our stakeholders.” Such rhetoric underscores the belief that this deal is not merely a corporate transaction but a critical move for stabilizing the steel industry’s future amid a complex geopolitical landscape.

The opposition to the acquisition is not merely a matter of regulatory scrutiny; it intertwines with political sentiments and the vital role of unions in American labor dynamics. Both Biden and the former president, Donald Trump, have traversed the terrain of union support while navigating the complexities of foreign investment during their respective campaigns. The labor unions, notably the United Steelworkers, exhibit firm resistance to this acquisition, which they perceive as a potential threat to American jobs and domestic production capacity.

The union’s vocal opposition can be seen as a reflection of broader anxieties regarding the impact of foreign ownership on essential industries. This atmosphere of apprehension has essential ramifications not just for Nippon Steel and U.S. Steel, but also for the very fabric of U.S. trade policy and its alignment with national strategic objectives.

The broader implications extend beyond just corporate interest to national relationships, particularly with Japan. The remarks by Japanese Foreign Minister Takeshi Iwaya highlight the delicate nature of international business transactions in the context of diplomatic relations. By indicating that the blockage is “highly regrettable,” Iwaya alludes to the potentially fraught atmosphere brewing between the U.S. and one of its key allies.

Japanese investments significantly contribute to the U.S. economy, complicating the narrative surrounding national security. It raises the stakes for U.S. policymakers to ensure that decisions taken do not alienate a major investor while striving to maintain domestic integrity. As Japan’s largest investor status brings with it concerns over the sustainability of the economic ties between the two nations, negotiations around the acquisition must proceed with a clear understanding of these dimensions.

As the June deadline approaches, the outcome of this standoff between Nippon Steel and the Biden administration will undoubtedly shape the U.S. steel industry and foreign investment landscape. The interplay of national security, political agendas, corporate strategies, and international relations presents a complex tapestry that will require deft handling. Stakeholders must remain vigilant and proactive as they navigate this crucial juncture, balancing the objective of securing a competitive future for U.S. industries with the realities of an interconnected global economy. The reverberations from this case will not only affect current players in the market but will also influence how future foreign investments are perceived and managed under U.S. law.

Leave a Reply