Investors are always on the lookout for pivotal events and data that could influence market trajectories. As we delve into the latest happenings, we uncover a mix of economic indicators, labor disputes, corporate performance, and significant legal proceedings all contributing to the trading landscape. This article sheds light on recent developments impacting major stock indices and the broader economic environment, providing investors with essential insights as they navigate the market.

The S&P 500 has been on an impressive streak, marking its fourth consecutive day of gains and climbing 0.75%. Notably, the tech sector has shown even more robust performance, with the Nasdaq Composite advancing by 1%. Responding to strong earnings and positive investor sentiment, tech stocks have garnered significant buying interest. Meanwhile, the Dow Jones Industrial Average added 235.06 points, or 0.58%, reflecting a broad-based enthusiasm among investors.

A noteworthy driver of these market movements has been the producer price index (PPI), a key inflation measure. The latest report indicated a modest 0.2% increase in wholesale prices for August, aligning closely with market expectations. This data point serves as the last major economic indicator before the highly anticipated Federal Reserve meeting scheduled for the following week. Investors are keenly awaiting insights into future monetary policies, which frequently hinge on inflation metrics like the PPI.

In an unexpected turn of events, over 30,000 workers at Boeing have commenced a strike following the rejection of a tentative contract agreement. This action halts production on Boeing’s best-selling aircraft and signifies deeper issues within labor relations at the aerospace giant. The strike, characterized as an “unfair labor practice strike” by IAM District 751 President Jon Holden, highlights the ongoing tensions between employees and management.

Boeing has acknowledged the need to reset its relationship with its workforce and expressed a commitment to renegotiating terms. As the company grapples with a history of operational challenges, this strike could exacerbate its recovery, potentially affecting both production timelines and financial performance. Investors should remain alert, as labor disputes can significantly impact stock performance and corporate stability.

Tech company Adobe recently released its third-quarter earnings report, which beat analyst expectations in terms of both sales and earnings. However, in an unusual twist, the company’s stock saw a decline of approximately 8% in premarket trading. The unsettling aspect for investors was Adobe’s cautious guidance for the fourth quarter, which fell short of what was anticipated by analysts.

While the company reported an impressive 11% year-over-year increase in subscription revenue, the projected earnings per share of $4.63 to $4.68 came in beneath the anticipated $4.67. Similarly, revenue forecasts were adjusted downwards, signaling potential hurdles in maintaining momentum. For investors, this situation raises questions not only about Adobe’s immediate prospects but also about broader market conditions impacting tech stocks.

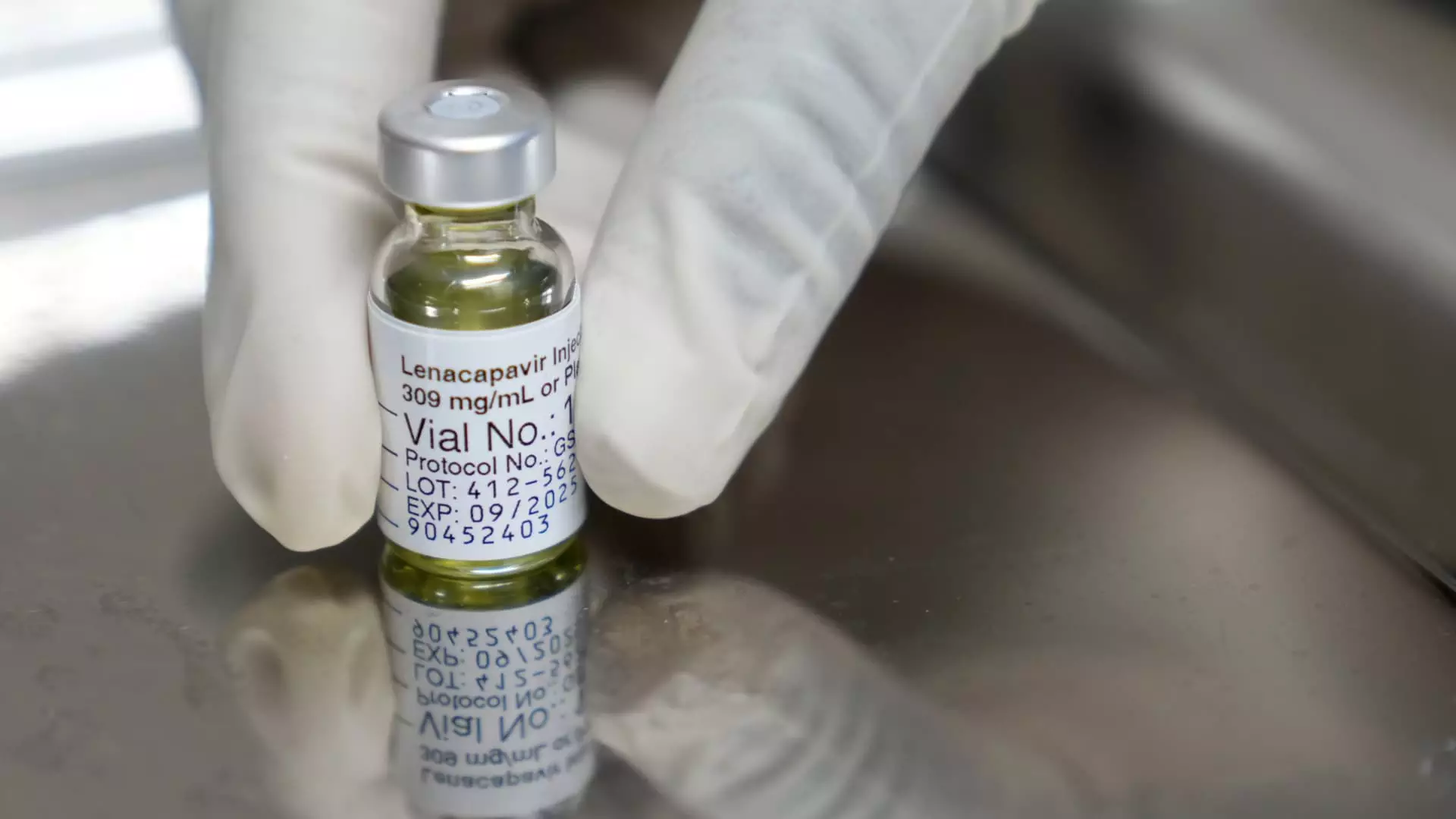

In a significant development within the pharmaceutical sector, Gilead Sciences announced groundbreaking results from a trial of its innovative twice-yearly HIV shot, lenacapavir. The trial showcased an astonishing 96% reduction in HIV infections, with only two positive cases recorded among 2,180 participants. This evidence paves the way for potential FDA approval, marking a milestone in HIV prevention efforts.

The implications of this medical advancement extend beyond public health, as successful drug trials often correlate with increased investor confidence and stock performance for pharmaceutical companies. Gilead’s positive trial results not only signify a step forward in combating HIV but could also strengthen its market position and appeal to investors in the healthcare sector.

As New York Fashion Week draws to a close, the spotlight shifts to the courtroom, where Tapestry (owner of Coach) and Capri Holdings (parent company of Michael Kors) are contesting a significant merger deal valued at $8.5 billion. The initial announcement of this merger came over a year ago, but regulatory pushback from the FTC has complicated the process. The FTC’s lawsuit aims to block the merger, citing concerns over competition and pricing within the handbag market.

The outcome of this legal battle holds critical implications not only for the involved companies but also for the retail sector at large. With competition claims hanging in the balance, the merger’s potential approval could reshape market dynamics, influencing everything from pricing strategies to consumer choice in the luxury segment.

As investors navigate these complex market waters, understanding the intricate interplay between economic indicators, labor movements, corporate performance, and regulatory challenges will be essential in positioning themselves for success. Each of these developments offers unique insights into potential market trends, and astute investors should be ready to adapt as circumstances evolve.

Leave a Reply