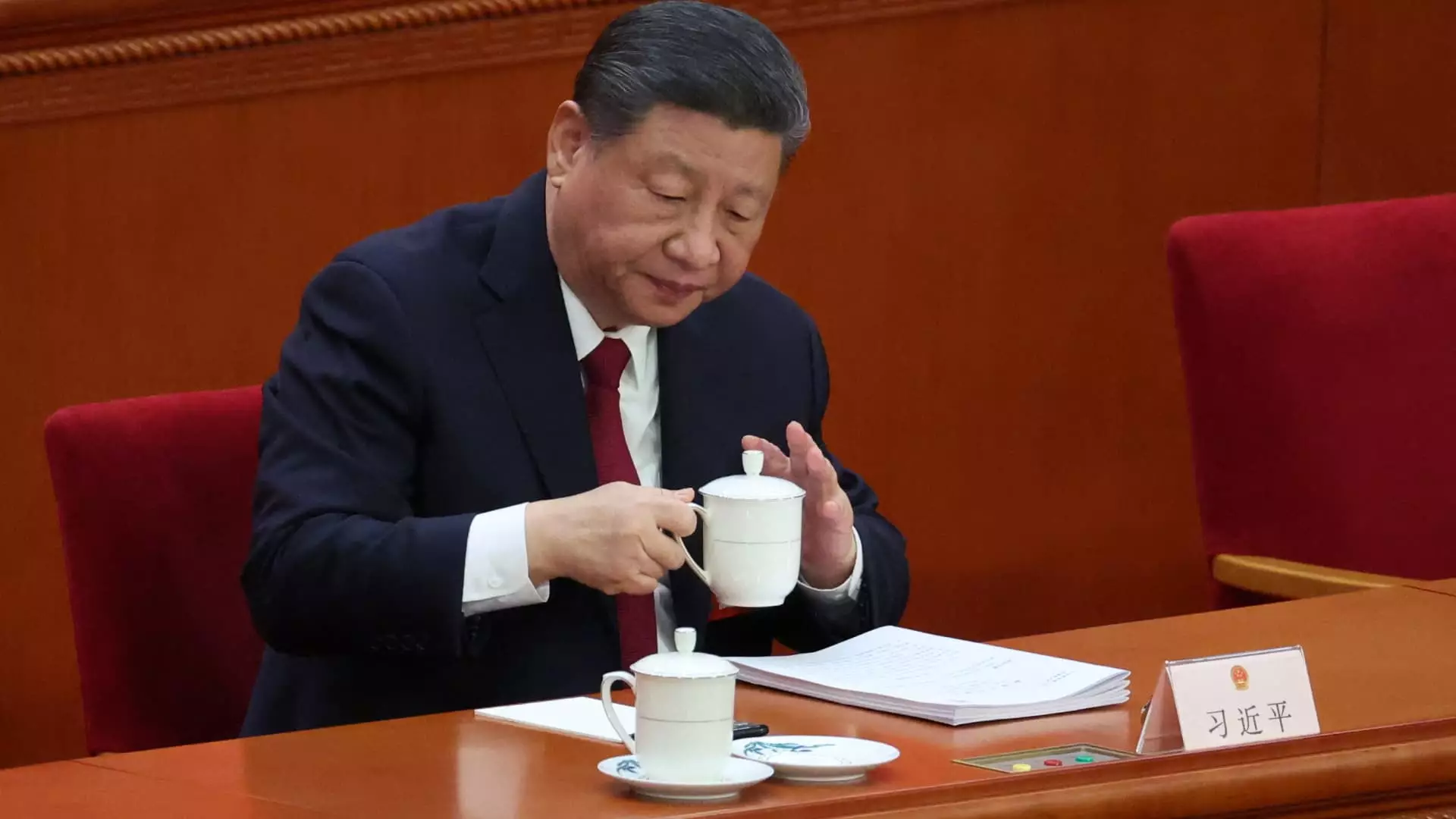

In a troubling reflection of our current times, China finds itself grappling with intensified external shocks that jeopardize its economic stability. In light of these challenges, President Xi Jinping recently presided over a Politburo meeting where the emphasis was placed on rescuing struggling businesses through a set of targeted measures. As the Chinese economy strives to achieve an ambitious growth target of “around 5%” for the year, the urgency for innovative solutions becomes palpable. Yet, one cannot help but question whether the proposed responses genuinely address the gravity of the situation or merely serve as a stopgap for deeper economic malaise.

The backdrop to this meeting is characterized by heightened tensions with the United States, leading to a slew of retaliatory tariffs that effectively choke off trade. Wall Street is not optimistic; major banks have recalibrated their GDP forecasts for China downward, indicating a lack of confidence in the nation’s ability to rebound amid mounting pressures. The fear that China is now engaging in a battle of trade attrition invites skepticism about the efficacy of any measures that are seemingly reactive rather than strategic.

Targeted Measures: An Insufficient Band-Aid

While the Chinese government’s commitment to provide multifaceted assistance to beleaguered businesses appears commendable on the surface, the measures outlined reveal a haphazard approach characterized by improvisation. Financial support and interest rate adjustments are mentioned as part of the toolkit for alleviating pressure on businesses. However, without a coherent strategy that goes beyond immediate relief, these policies risk being akin to slapping a band-aid on a gaping wound. Economic distress requires not just quick fixes, but a thoughtful, long-term strategy to build resilience against future shocks.

Financial expert Zong Liang’s assertion that the government may need to conduct further research into specific industries is a telling sign of the uncertainty surrounding these measures. If policymakers feel the need to “monitor and evaluate” the situation, one must ask if they truly understand the underlying issues at play. The ad hoc nature of the proposals reflects a government caught off guard, struggling to piece together a response in a rapidly evolving economic landscape.

Potential for Greater Transformation

China’s economic woes are indicative of a larger global trend; growing interdependence amidst geopolitical tensions makes every nation susceptible to external shocks. Furthermore, the recent elevation of China’s deficit target to 4% of GDP signals a crucial turning point in fiscal policy. Yet, these actions should not be mere strategic gestures. What is required is a foundation for innovation that transcends temporary fiscal adjustments. The call for increased income among middle and lower-income groups, alongside a focus on service consumption, hints at a desire to stimulate internal demand. However, if economic growth is based solely on reactive policies, rather than systemic transformation, the risk remains that the economy will continue to flounder.

The proposed integration of artificial intelligence into China’s economic infrastructure is another promising direction, yet the effectiveness of this strategy hinges on the government’s commitment to invest adequately in technology and education. The Politburo’s ambiguous stance regarding large-scale stimulus depersonalizes the economic crisis; it feels more like a bureaucratic discussion than a commitment to meaningful change. As experts point out, without a robust framework for private sector engagement and collaboration, China runs the risk of stagnation in a rapidly digitalizing world.

As China navigates these treacherous waters, it becomes evident that half-measures will not suffice if the country hopes to emerge resilient on the other side of global uncertainty. The erratic nature of policies indicated by the recent Politburo meeting raises fundamental questions regarding the leadership’s ability to adapt and innovate in the face of adversity. The world is watching China’s next moves closely, and a lack of robust, integrated policies will only serve to amplify doubts about its economic future. The time for decisive and imaginative action is now—before these “targeted measures” fade into mere footnotes in the annals of economic history.

Leave a Reply