In a financial landscape as tumultuous as a hurricane, Warren Buffett’s Berkshire Hathaway has emerged as a beacon of resilience, showcasing a meaningful lesson in traditional capitalism. Amid President Trump’s chaotic introduction of aggressive tariffs that sent shockwaves through Wall Street, the conglomerate navigated the rough waters with a relatively modest decline of 6.2% in its Class B shares. This decline, while substantial, pales in comparison to the broader market’s alarming retreat—9.1% for the S&P 500 and a staggering 10% hit for the Nasdaq Composite. Such numbers reveal not only the market’s volatility but also highlight Berkshire’s unique positioning as a defensive stalwart in uncertain economic times.

A Diversification Defense

Berkshire Hathaway’s diversified portfolio stands as a fortress against market turmoil. Unlike tech-dominated counterparts, Berkshire’s vast interests in sectors like insurance, energy, and retail provide a cushion against economic shocks. As the nation grapples with uncertainties unleashed by trade wars, the company’s stable revenue streams from insurance premiums and consumer products instill a sense of safety. It is this very diversification that renders Berkshire an attractive option for wary investors hunting for solid ground amid an otherwise precarious economic environment. The company’s ongoing performance, still buoyed by an approximate 8% gain this year, reinforces an essential point: during turbulent times, a well-rounded approach can prove more beneficial than speculative ventures.

A Unique Position in Market Metrics

In times of chaos, market indicators often serve as a lighthouse to guide investors away from rocky shores. Berkshire Hathaway holds a notable distinction as the only one of the ten largest S&P 500 companies still trading above its 200-day moving average. This metric, revered among technical analysts, speaks volumes about investor confidence in the security of Buffett’s company. As this moving average serves as a long-term trend line, being positioned above it indicates resilience and suggests investor faith in its long-term profitability, even when almost all else seems to be sinking in the storm.

Rich Ross from Evercore ISI points out that while this metric isn’t infallible, it’s telling: “Berkshire is the only ‘Top 10’ stock in the S&P above it.” The ongoing faith of investors in Berkshire’s stability, even when weighed against the erratic behaviors of corporate entities tethered to the whims of political strategies, illustrates a desire for safety in the ongoing economic unpredictability.

Evading the White House’s Shadow

The gravity of Trump’s decisions looms large over Wall Street, but Berkshire Hathaway stands somewhat apart. Investors like Josh Brown of Ritholtz Wealth Management expound on this crucial detachment, noting that Berkshire’s performance is less tethered to the outcomes of political maneuverings. “There are certain companies that do not live or die based on where the 10-year Treasury yield is,” Brown asserts, emphasizing Buffett’s focus on the underlying fundamentals of the American economy rather than reactive strategies aimed solely at navigating fleeting policies.

This independence affords Berkshire a unique advantage, allowing it to weather the storm with a formidable balance sheet boasting $334 billion in cash reserves—a financial warchest that can endure any temporary setbacks. It reflects a pivot away from the chaotic impulses of Washington and towards a more grounded, economic-driven ethos that prioritizes stability above sensationalism.

The Reputation in Peril

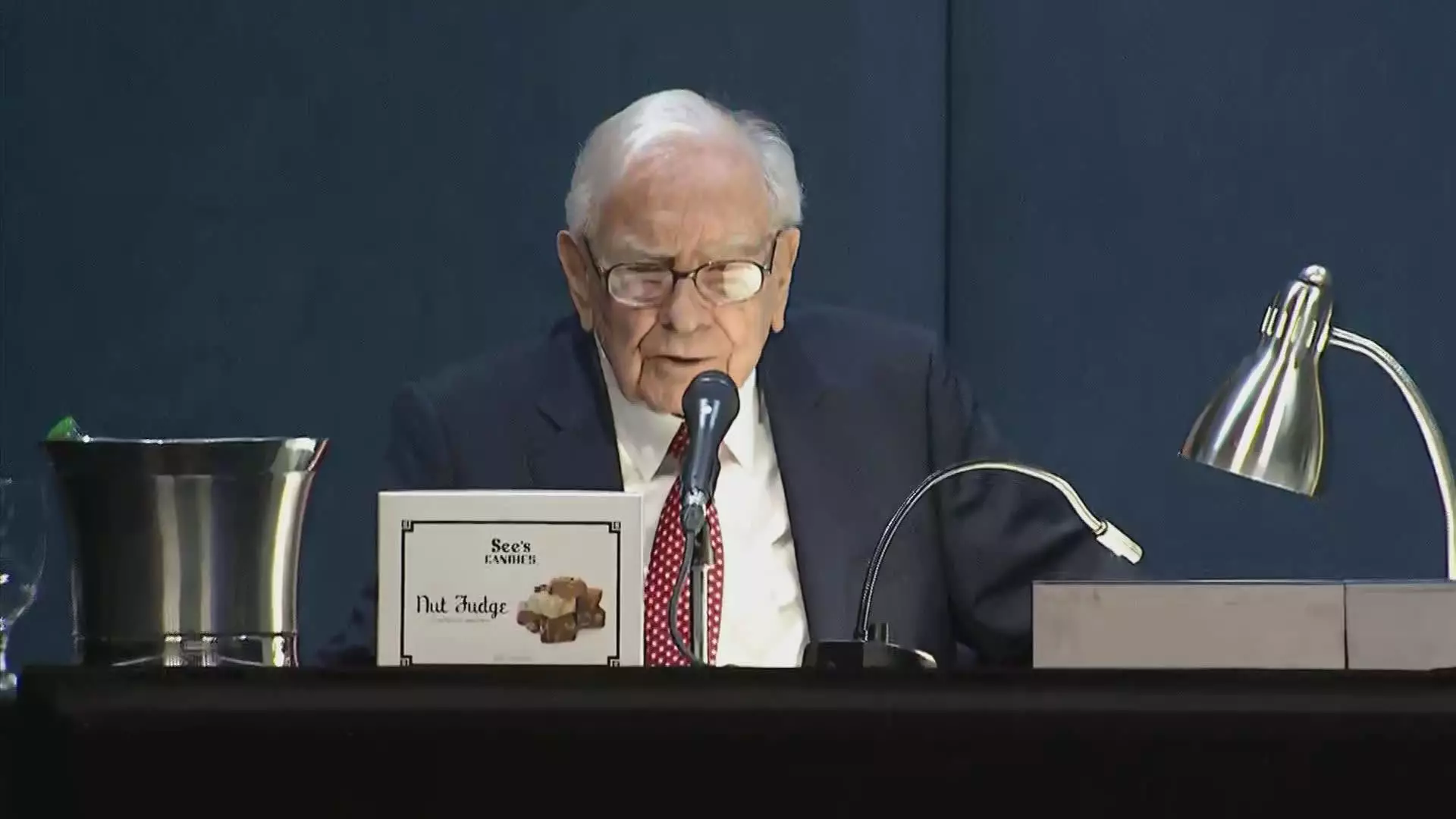

However, the political climate is fraught with complexities and contradictions. Recently, Buffett found himself drawn into the political fray after President Trump shared a video on social media, erroneously implying Buffett’s endorsement of a view that criticized Trump’s handling of the stock market. In a world where the nuances of investment management can easily become muddied by the pavements of sensational political commentary, Buffett’s name—long regarded as synonymous with wisdom and credibility—was thrust into an unwelcome narrative.

In an ironic twist, this incident serves as a reminder of the enduring consequences of intertwining corporate reputation with political discourse. The veneration of Buffett’s investing philosophy is not merely about the numbers; it is also about integrity and character in a tumultuous world of fiscal intrigue. The ability to separate Wall Street from the White House becomes increasingly imperative, raising a poignant question: can iconic figures like Buffett maintain their impartiality amidst the chaos of political entanglement?

As the future unfolds, Berkshire Hathaway stands as a crucial case study in adept management against both market and political turbulence. The broader implications for investors are profound: the determination to seek shelter in steadfastness, adaptability, and unwavering principles amidst the gale of irrationality.

Leave a Reply