In a striking move, the Consumer Financial Protection Bureau (CFPB) has instructed its employees to work remotely following an announcement that the agency’s Washington, D.C., headquarters will remain closed until at least February 14. This unexpected directive, communicated through a memo from Chief Operating Officer Adam Martinez, raises eyebrows concerning the stability and operational integrity of the agency. The decision to shift to remote work highlights not just a logistical adjustment but also deep concerns regarding the agency’s future and its capacity to fulfill its mandated role in overseeing and regulating financial institutions.

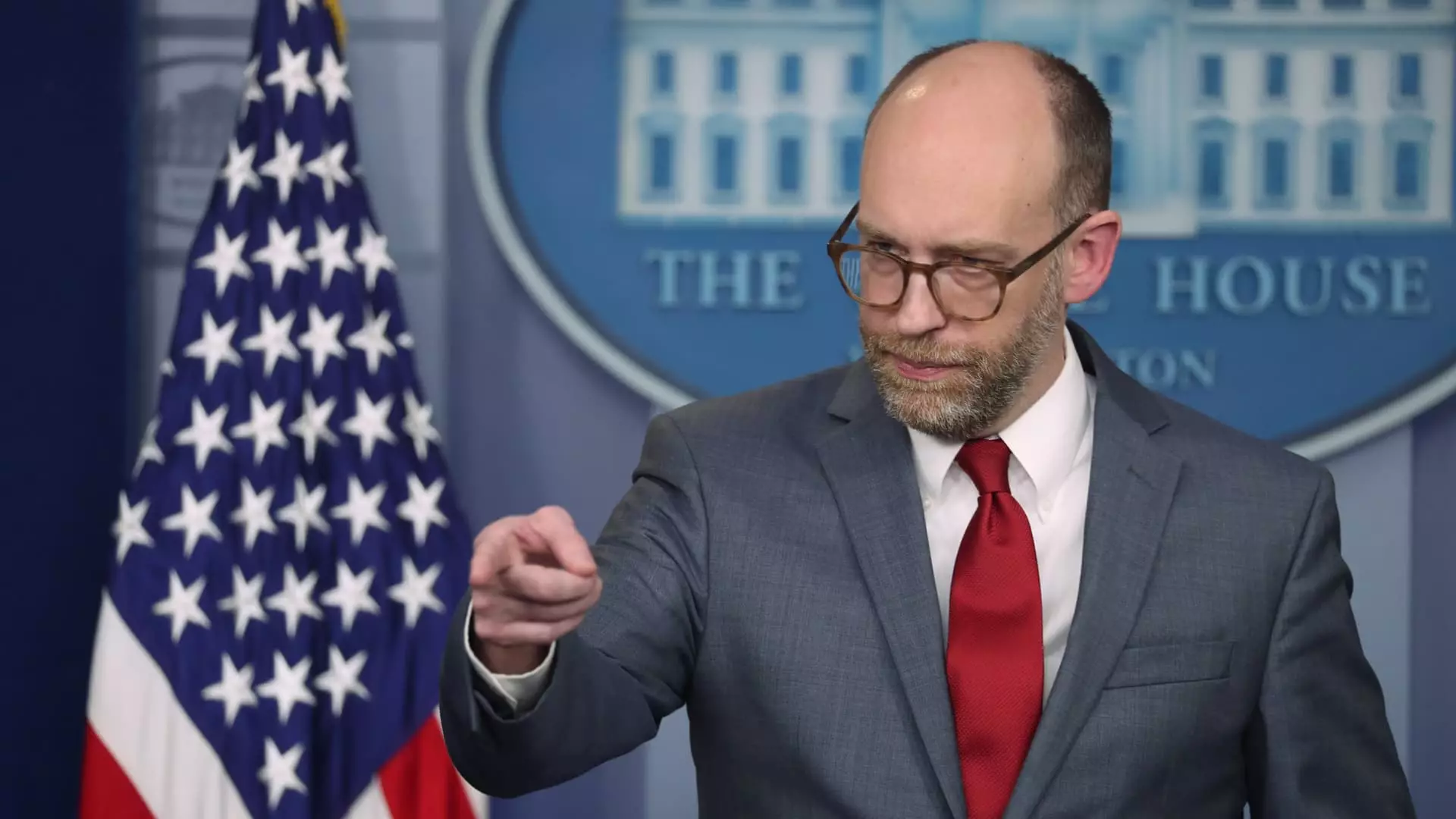

The recent directive comes just a day after a memo issued by Russell Vought, the newly appointed acting director of the CFPB. This memo instituted a suspension of nearly all the bureau’s regulatory activities, including the oversight of financial firms, which marks an unprecedented operational freeze for an entity responsible for consumer protection in financial markets. This immediate halt not only disrupts existing regulatory activities but poses a significant question: What is the ultimate direction for the CFPB under new leadership, especially given Vought’s history and the political pressures surrounding him?

Compounding the issue of operational paralysis is the recent intrusion of personnel associated with Elon Musk’s DOGE into the CFPB. Reports suggest that these operatives have been granted unauthorized access to sensitive data sources within the bureau, including individual staff performance reviews. Such access not only concerns employee privacy but also endangers the integrity of regulatory processes, raising alarms about accountability and transparency within the CFPB. Musk has previously expressed his disdain for the agency, even advocating for its dissolution. His public declarations, which include a recent post on social media branding the CFPB as “RIP,” further fuel speculation regarding an agenda to dismantle its authority.

Vought’s memorandum did not just impose a freeze on agency activities but also marked a significant shift in funding policies. His newly announced measures to halt the flow of new financial resources to the CFPB suggest a deliberate tactic aimed at destabilizing the agency’s operations. As Vought pointed out, this change in funding was intended to combat perceived unaccountability within the agency. However, such restrictions could erode public trust and diminish the CFPB’s ability to execute its essential functions of protecting consumers from financial malpractice.

The series of unsettling decisions and actions surrounding the CFPB indicates a tumultuous period ahead for a federal agency already grappling with criticism and scrutiny. With leadership shifts, alleged intrusions by corporate personnel, and new funding challenges, the CFPB faces an uncertain future that could fundamentally reshape the landscape of consumer financial protection. Stakeholders within the financial industry and consumer advocacy groups alike will be watching closely as these developments unfold, as they hold significant implications for regulatory practices and consumer rights in the financial sector.

Leave a Reply