The Trump administration has outlined a strategy centered around managing Treasury yields, embracing fiscal policy dynamics rather than conventional Federal Reserve intervention. This paradigm shift marks a significant departure from previous approaches, highlighting a broader understanding of the intricate relationship between government policy and economic indicators. By prioritizing the manipulation of the 10-year Treasury yield over the federal funds rate, the administration underscores a distinct plan aimed at sustaining a favorable economic environment.

Understanding Treasury Yields and Their Importance

Treasury yields are critical barometers for economic health, influencing a broad spectrum of financial products, from mortgages to consumer loans. The 10-year Treasury yield, in particular, serves as a crucial reference point for investors and market analysts. Elevated yields typically indicate rising inflation expectations and can signal tightening financial conditions that may stifle economic growth. Conversely, lower yields often foster a conducive environment for borrowing and investment, which is essential for robust economic development.

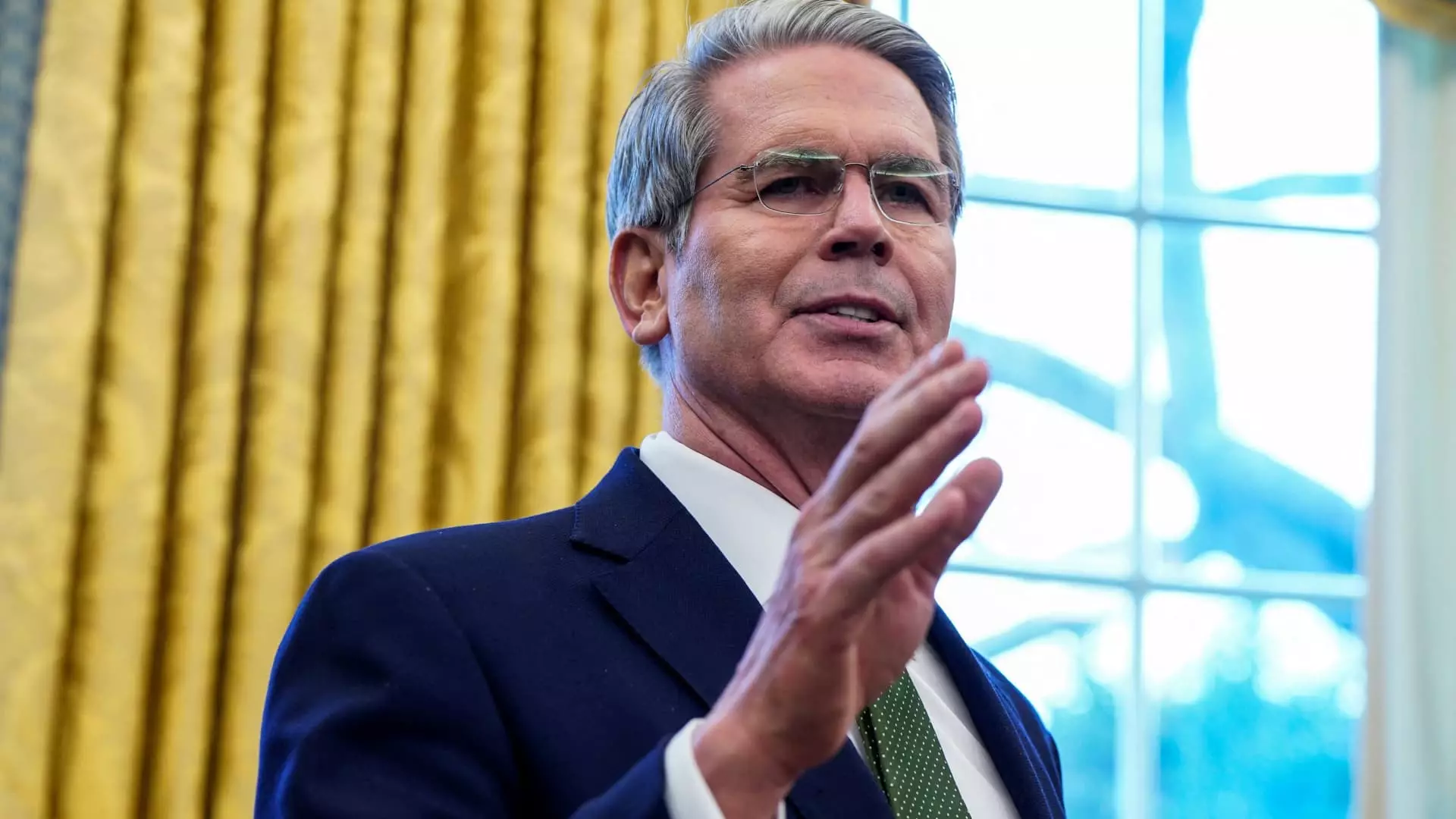

Scott Bessent, Treasury Secretary, articulated the administration’s focus on the 10-year Treasury yield during a recent interview. In express terms, Bessent indicated that the president’s desire for lower rates does not necessitate direct Federal Reserve action, suggesting a belief in fiscal mechanisms as the primary tools for achieving desired outcomes.

The Shift from Federal Rates to Treasury Outcomes

In the face of economic turbulence, the Trump administration appears to adopt a philosophical stance that emphasizes the independence of fiscal policy from central bank strategies. The recent initiation of a rate-cutting cycle by the Federal Reserve resulted in decreased funds rates, but paradoxically, this environment was met with an increase in Treasury yields. This ongoing disconnect raises vital questions about the efficacy of traditional monetary policy measures and signals a growing consensus around the significance of fiscal approaches in economic stabilization.

Bessent further asserted that the administration does not seek to pressure the Federal Reserve for rate cuts as seen during Trump’s first presidential term. Instead, there’s an assertion of confidence in the endogeneity of markets; if the right conditions are set—through tax reforms, deregulation, and energy policy—the market forces would naturally lead to lower rates.

The administration’s strategy involves a comprehensive reform agenda intended to cement long-term economic stability. Key priorities encompass making the Tax Cuts and Jobs Act permanent, encouraging energy exploration, and implementing deficit reduction measures. The rationale behind these reforms is to reduce the size of government while promoting efficiency within government operations. Unlike the reactive monetary policies that characterize the Fed, this proactive fiscal strategy is aimed at constructing a solid foundation for economic growth.

Bessent’s commentary reflects a belief that a holistic approach—comprised of deregulation, efficient governance, and energy sector expansion—could fundamentally shift the interest rate landscape. As he pointed out, achieving fiscal consolidation could shape market dynamics favorably, allowing for a more stable and predictable economic environment.

Market observers note the potential implications of the administration’s policy focus on Treasury yields. Financial analysts like Krishna Guha of Evercore ISI suggest that the administration’s approach may be aimed at preventing the 10-year yield from crossing the psychological threshold of 5 percent. Exceeding this marker might compromise the delicate balance of “Trumponomics,” potentially triggering adverse effects on equity markets and sectors sensitive to interest rates, such as housing.

Contrary to earlier expectations, the 10-year Treasury yield recently declined to approximately 4.45%, indicating an easing of previous upward pressures. The administration’s favorable reception toward the Fed’s decision to maintain stable funds rates adds another layer of complexity, fostering a more collaborative atmosphere between fiscal and monetary policies.

The Trump administration’s keen focus on Treasury yields as a central tenet of economic strategy reflects an evolving understanding of market mechanisms. By pivoting from reliance on the Federal Reserve to utilizing fiscal policy levers, the administration advocates for a holistic growth model. As the economic landscape continues to change, the effectiveness and longevity of this approach will warrant close scrutiny, shaping the broader discourse around fiscal and monetary policy in America’s future economic infrastructure.

Leave a Reply