The recent sentencing of Ilya Lichtenstein has shed light on the murky waters of cryptocurrency crime and the extensive implications that follow such heinous acts. The case, revolving around the 2016 hack of the cryptocurrency exchange Bitfinex, highlights not only the theft of a staggering 120,000 bitcoins but also the sophisticated money laundering strategies employed to conceal these assets after the illicit acquisition. Lichtenstein’s actions, and subsequent sentencing, provide a poignant case study about the intersection of technology, law, and ethical accountability in the digital age.

In 2016, when Lichtenstein executed the hack on Bitfinex, the market valuation of the stolen bitcoins was approximately $70 million. However, the dramatic increase in bitcoin’s value since then has turned the stakes significantly higher, positioning the worth of the stolen crypto at a jaw-dropping $10.5 billion today. This case stands as one of the largest thefts from a virtual currency exchange, meaning that Lichtenstein’s actions not only represented a personal crime but also inflicted severe repercussions on the broader cryptocurrency market and its stakeholders.

The sheer extent of this operation is staggering, involving more than 2,000 unauthorized transactions. Such large-scale cyberattacks often reveal vulnerabilities in security measures and prompts a raised awareness about the importance of data integrity and protective technologies within exchanges. The Bitfinex hack serves as a grim reminder to other exchanges about the continuous necessity for evolving security protocols to combat the ever-evolving cyber threats.

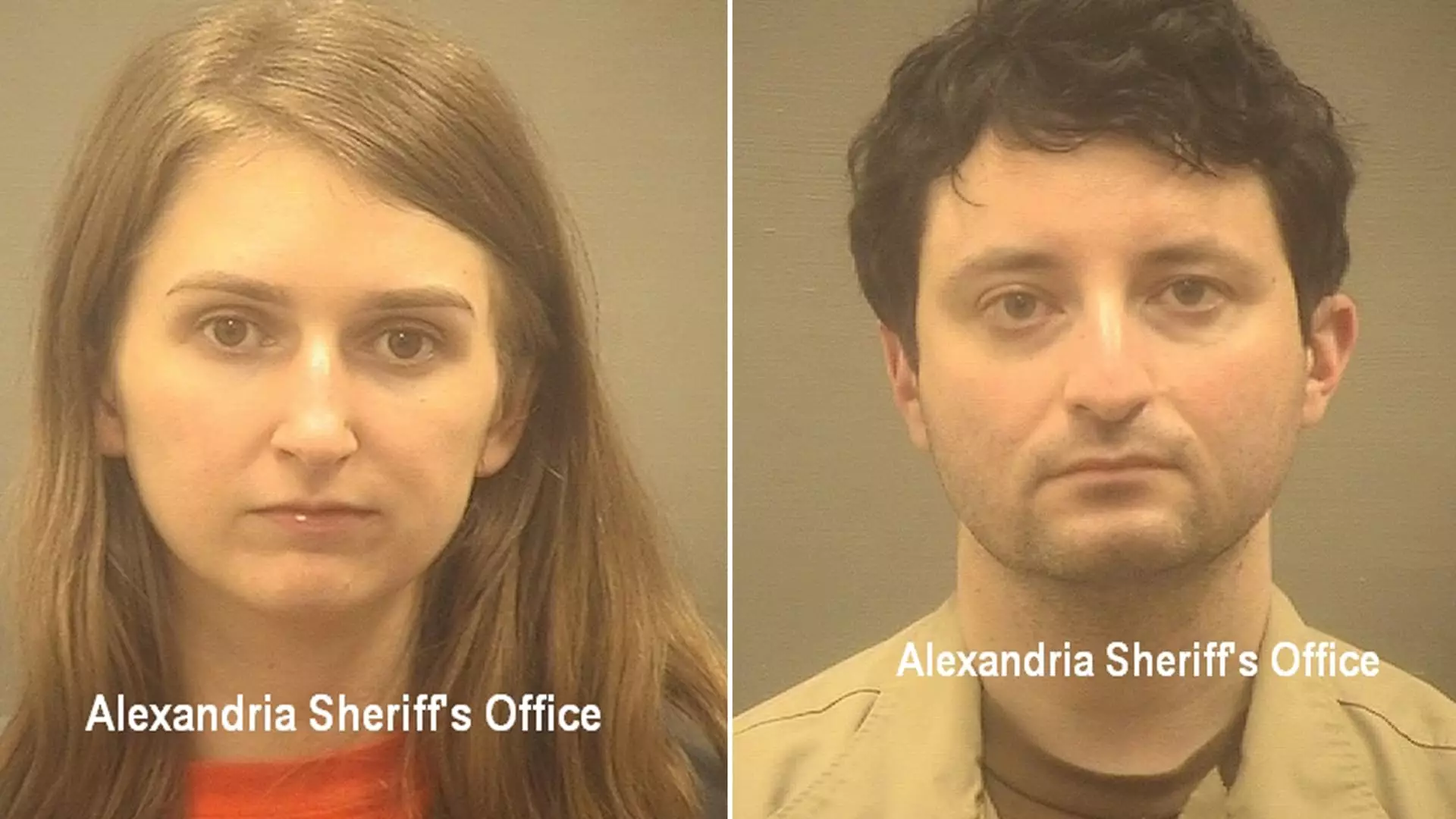

Lichtenstein, alongside his wife Heather Rhiannon Morgan, pleaded guilty to a money laundering conspiracy that was described by prosecutors as unprecedented in its complexity. The couple’s elaborate techniques reportedly foiled detection for years, showcasing their sophisticated understanding of financial systems and the illicit cryptocurrency landscape.

During the course of their operations, they utilized numerous methods including multiple accounts, transfers through various wallets, and the use of cryptocurrency mixing services, all of which are tactics designed to obfuscate the trail back to the original theft. Prosecutors went so far as to characterize Lichtenstein as one of the most adept money launderers the government had encountered in the cryptocurrency domain, indicating the pervasive challenge of tracking illicit funds in a space characterized by relative anonymity.

The sentencing of Lichtenstein to five years in prison, along with three years of supervised release, has ignited discussions surrounding the adequacy of justice in addressing cybercrime. Although Lichtenstein faced a potential maximum of 20 years, he will likely serve a reduced term, reflecting the complex nature of sentencing in cases involving cyber-related fraud.

Judge Colleen Kollar-Kotelly’s decision appears to balance the need for accountability with an acknowledgment of Lichtenstein’s portrayal of remorse during his hearing. He expressed a desire to make amends for his actions, but skepticism remains. Are such sentences effective deterrents for would-be cybercriminals, or do they merely offer a slap on the wrist for high-stakes thefts that yield significant financial rewards?

As Lichtenstein prepares to serve his sentence, discussions surrounding cryptocurrency regulation and accountability are more relevant than ever. The ensuing investigations into the stolen bitcoin have prompted government actions aimed at returning significant amounts of the stolen assets to Bitfinex and other potential victims.

This case highlights the challenges regulatory bodies face in keeping pace with the rapid innovations within the cryptocurrency market. The withdrawal of funds linked to cyber crimes not only raises questions about security and trust within the system, but also presses for a governance structure capable of handling sophisticated financial crimes that transcend traditional methods of fraud.

Ilya Lichtenstein’s sentence has not only paved the way for justice in this particular case but also emphasizes the ongoing struggle against cybercrime in the evolving landscape of digital currencies. It serves as a critical reminder of the responsibilities that come with technological advancement and the societal obligations that must be upheld to ensure a secure and equitable financial environment for all.

Leave a Reply