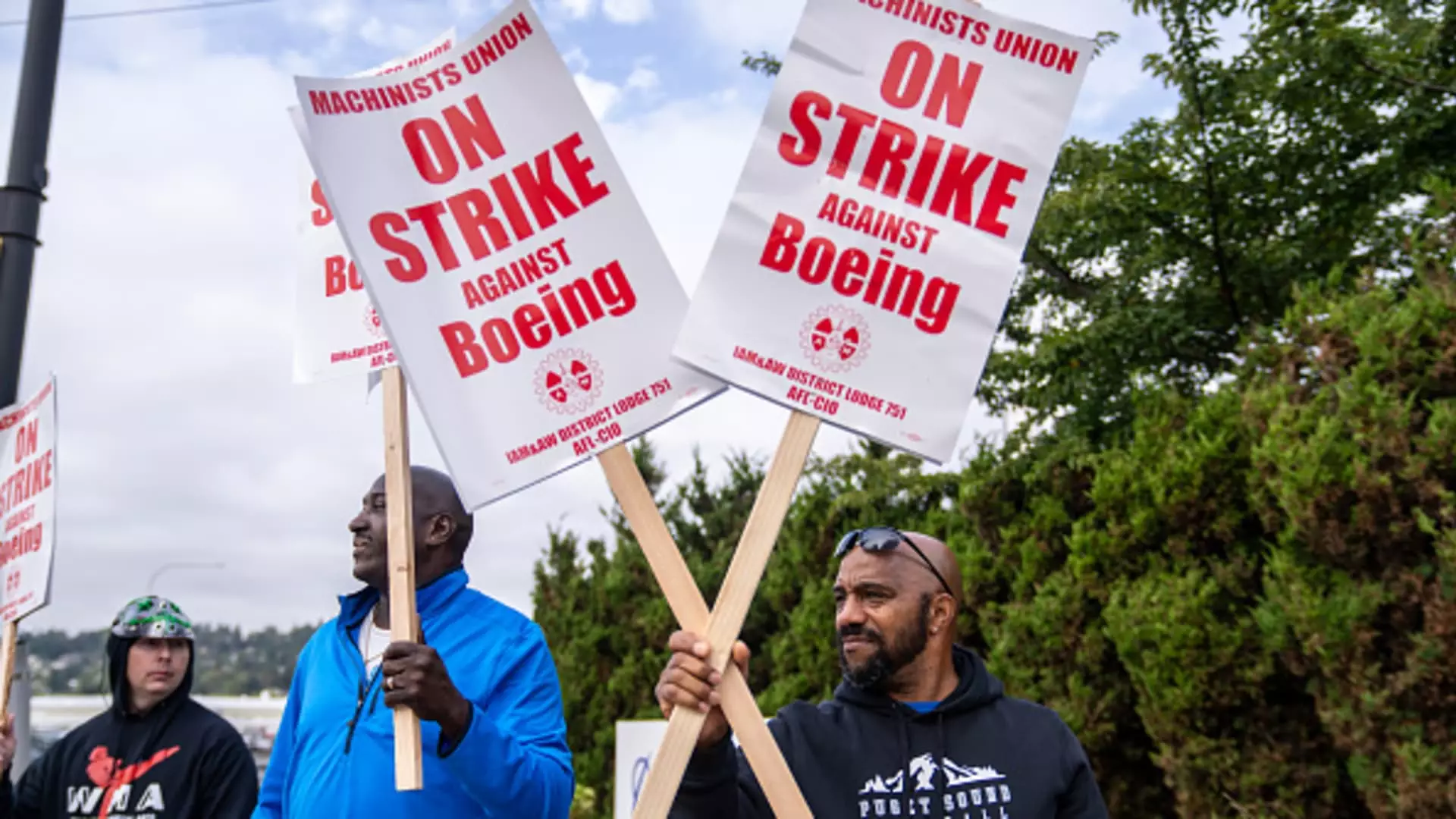

The aviation industry is no stranger to upheaval, but current circumstances surrounding Boeing pose a complex narrative of labor tensions, financial turmoil, and a reevaluation of operational strategies that could potentially shape the future of one of America’s historic manufacturers. A month has elapsed since over 30,000 machinists at Boeing initiated a strike, a decision that has not only accentuated internal conflict but has also amplified external pressures on the company’s leadership.

In late September, a decisive vote led to a significant walkout by Boeing’s machinists, reflecting deep-seated dissatisfaction with a tentative contract that was overwhelmingly rejected by the workforce. S&P Global Ratings has estimated that this disruption could cost Boeing approximately $1 billion each month, exacerbating an already precarious situation faced by the company and its newly appointed CEO, Kelly Ortberg. This labor dispute arises in a context marred by recent crises, including the catastrophic failure of a 737 Max door plug earlier in the year and the shadow of two fatal crashes that dramatically tarnished Boeing’s reputation. Thus, the strike is more than a labor issue; it represents a flashpoint in a long-standing battle for quality, safety, and profitability.

As production lines halt, Boeing faces a dearth of cash flow, exacerbated by the union’s firm stance against what they deemed insufficient contract terms. The breakdown in negotiations points to a larger issue of trust and historical grievances that complicate the bargaining landscape. Ortberg, who assumed leadership during a critical period, now must navigate both the labor strife and the company’s dire financial forecasts while regaining stakeholder confidence.

Despite the significant financial burdens of the strike, union leaders like IAM District 751 President Jon Holden have advocated for renewed negotiations, emphasizing the need for a resolution that addresses workers’ needs. This call for dialogue feeds into a larger narrative about employee relations and corporate strategy. The IAM union’s demands, including a return to a pension plan, highlight a fundamental clash between labor expectations and corporate financial realities. While experts like Harry Katz predict a lasting conflict lasting two to five weeks, the absence of compromise has already led to an erosion of essential benefits for many workers, who now face the dual impact of lost wages and health insurance.

Boeing’s response has involved taking a critical stance against the union, claiming unfair labor practices, a strategy that hints at a desperate attempt to cast the resolution in a more favorable light. Ortberg’s administration must tread carefully; antagonistic approaches could alienate a workforce that feels undervalued, risking more profound disruptions in the operational framework of the company.

As the situation unfolds, it becomes increasingly apparent that Boeing must contend with daunting financial projections. Ortberg has informed employees of impending job cuts, including a reduction of the global workforce by about 10% and the cessation of its 767 freighter production once existing orders are fulfilled. This strategic pivot, combined with expectations of recording nearly $10 of losses per share for the third quarter, illustrates a clear crisis mode. Investors and analysts are understandably concerned, with projected declines in stock prices intensifying scrutiny on operational management practices.

Additionally, the company’s commitment to restructuring, aimed at refining its strategic focus, is essential yet perilous. As Ortberg posits a return to core competencies, the external environment remains fraught with competitive pressures and quality challenges that must be addressed immediately. The potential downgrade by S&P Global Ratings to junk status could reverberate through the financial sectors, further limiting options for liquidity and investment.

Boeing is at a critical juncture, forced to reevaluate its operational philosophies while grappling with immediate fiscal challenges. The ongoing strike and labor relations disruptions compel a reevaluation of how the company approaches not only its workforce but also its overall corporate governance. The need for innovative solutions and employee engagement has never been more urgent.

As the landscape in the aerospace industry shifts, the long-term impact of current decisions made by Boeing’s leadership will resonate beyond financial metrics. Rebuilding trust with employees and stakeholders, while innovating sustainably, is the key to navigating these tumultuous times and paving the way toward stability and growth. Whether Boeing emerges from this chaos stronger or merely survives remains uncertain, but the stakes could not be higher for America’s premier aerospace manufacturer.

Leave a Reply