In the ever-evolving landscape of the stock market, few events have the potential to trigger swift and significant investor enthusiasm quite like a reduction in interest rates by the Federal Reserve. Recent movements in tech stocks illustrate this dynamic vividly, as investors flocked to technology shares immediately following the Fed’s announcement of a benchmark interest rate cut for the first time since 2020. This momentous shift resulted in a remarkable 2.5% rally in the Nasdaq, establishing it as one of the most robust trading sessions this year. Central to the narrative are prominent companies like Tesla and Nvidia, whose impressive stock performances have steered the index closer to its peak levels.

Interest rates fundamentally influence the cost of borrowing, and the reduction has catalyzed a surge in tech stock investments. Historically, lower interest rates reduce the risk associated with speculative investments, characteristics that are prevalent within the technology sector. The Federal Open Market Committee suggested a further easing of monetary policy, hinting at additional rate cuts totaling up to 2 percentage points by the year’s end. This proactive approach symbolizes an environment that is increasingly favorable for tech stocks, which thrive on low borrowing costs and an influx of capital.

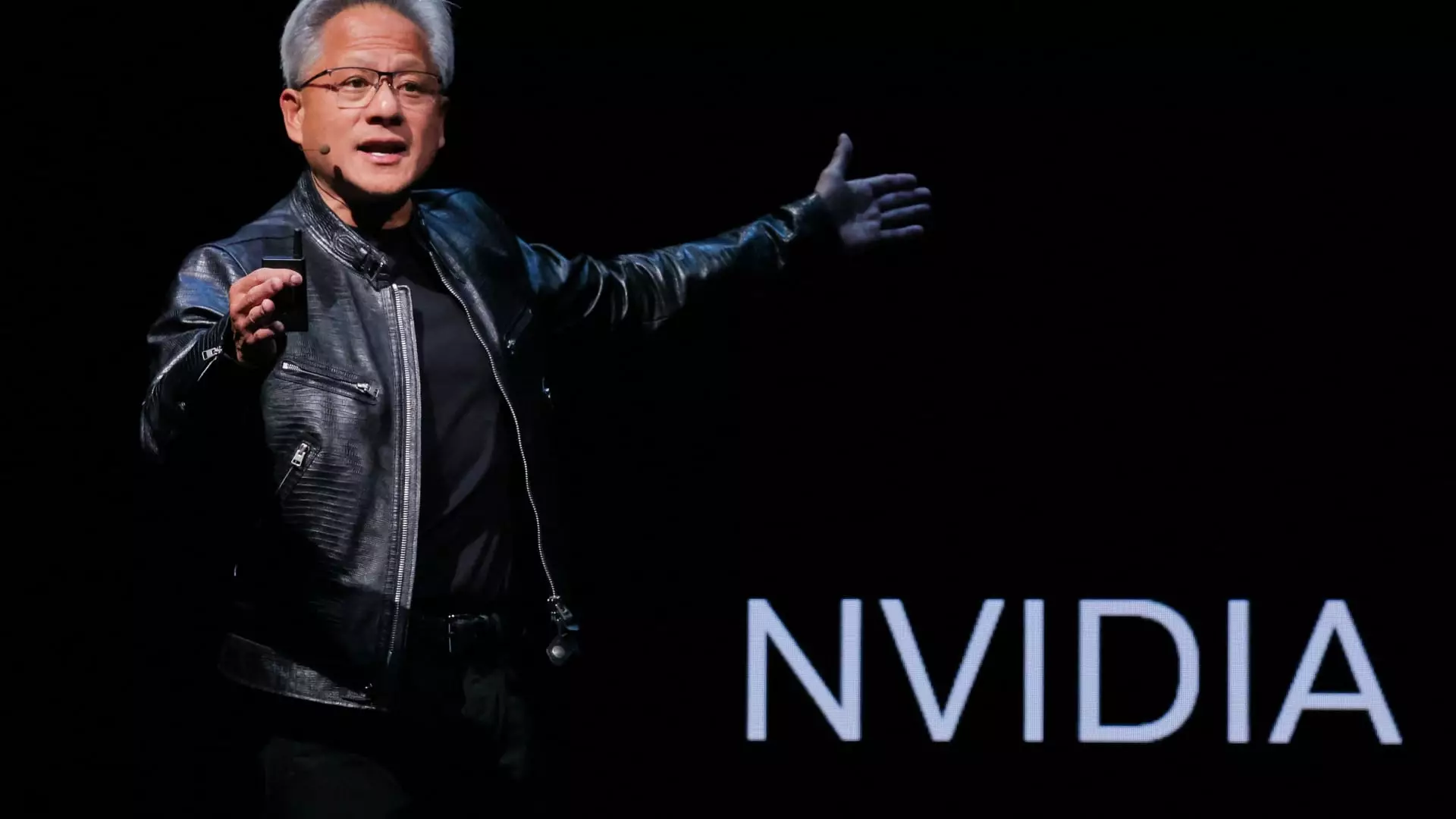

Nvidia stands out as a pivotal player in this tech-driven rally. The company experienced a 4% increase in its share price, up to $117.87, showcasing heightened investor confidence. Over the year, Nvidia’s stock has skyrocketed by approximately 138%, further bolstered by the burgeoning demand for its chips that facilitate artificial intelligence (AI) developments, such as those powering OpenAI’s ChatGPT. This meteoric rise, however, comes with a caveat—despite this impressive growth, Nvidia’s stock remains about 13% below its peak, raising questions about its future performance and the sustainability of demand.

Nvidia’s revenue is heavily concentrated among a select group of major clients, including tech giants like Microsoft and Alphabet. This reliance on a limited customer base can amplify risks for investors, especially if there are signs of declining demand. Notably, as companies scale their AI operations, they find themselves at the mercy of global demand trends. A downturn could invoke intensified scrutiny of Nvidia’s growth trajectory, making the company’s reliance on consumer confidence particularly concerning.

Alongside Nvidia, Tesla delivered an impressive performance, with a 7.4% gain that marked a significant rebound for the electric vehicle manufacturer. Despite starting the year on a low note—down nearly 2%—Tesla has managed to recover substantially, climbing 72% since its April trough. This resurgence signifies not only the brand’s resilience but also reflects broader investor sentiment favoring companies showcasing innovation and sustainability.

In contrast, Advanced Micro Devices (AMD) and Broadcom also surged, with gains of 5.7% and 3.9%, respectively. AMD’s CEO, Lisa Su, acknowledged the importance of patience in the evolving AI sector, suggesting that the technology’s integration into various industries, from education to drug development, remains in the nascent stages. This perspective echoes a critical sentiment in the tech world—sustained growth and innovation in AI will require a long-term vision, and immediate results may not be forthcoming.

As optimism prevails in the tech sector following the Federal Reserve’s monetary policy shift, investors must tread cautiously. The current rally might suggest a transition to a prolonged period of growth, yet history teaches us to be vigilant about market corrections that can arise swiftly. The heavy reliance of companies like Nvidia on a handful of key clients and the speculative nature of high-growth stocks can lead to volatility.

With that said, the interplay of competitive pressures, consumer demand, and fiscal policies must always be meticulously analyzed. Should trends shift, investors might find themselves recalibrating expectations in a rapidly transforming technological landscape. Overall, while the recent surge in tech stocks bodes well for the market, one must remain alert to the potential risks lurking beneath the surface—unlike sunlit peaks, the path through investments can often be fraught with challenges that require a discerning and critical eye.

Leave a Reply